Funding in the geospatial industry – the who and how

Recent world events (COVID-19 pandemic, hazards, wars, smart cities, etc.) significantly enhance the diverse applications of the geospatial industry, which is one of the most emerging industries in the world that attracts the investment community. The tremendous development of sensors technology (EO, Lidar, SAR, etc.) and AI analysis solutions are major factors for the revolution we are witnessing in this sector.

The geospatial technology solutions have been integrated into many fields including robotics, transportation, and aerospace. These solutions played a major role in developing the services and the capabilities across many business landscapes, enhanced by the great development of the technologies related to the collection and analysis of geospatial data.

In this article, we will continue to show the results of analyzing the data of 568 active companies founded after the year 2005 in the geospatial industry. The data was downloaded from crunchbase.com.

Geospatial Main Industries by Total Funding:

After analyzing the data of the 568 companies, we found that the investments in AI solutions by geospatial companies are around $2.597B. The advancement of AI and machine learning technologies creates a great opportunity for various applications in the geospatial industry that save a lot of time and money, such as object detection, semantic segmentation, picture classification, and geological hazard mitigation. One of the major effects of the new analytical methods through the integration of AI technologies in the geospatial industry is the improvement of the speed and accuracy of geospatial data-driven decision-making.

In addition, we found that the autonomous vehicle industry acquired around $2.238B, which represents 5.88% of the total investments in the geospatial industry. Driverless cars depend completely on the calculation of the location of the point cloud data in the geographic space that is collected from an extremely precise 3D map. Connecting self-driving cars with precise 3D and up-to-date geospatial information for every street is a key factor in achieving the best results.

Geospatial Main Industries Distribution Across Countries by Total Funding:

After analyzing the geospatial industries’ distribution across countries by focusing on the total funding, we found that the total funding for AI and Autonomous Vehicle solutions in the geospatial industry in China exceeds that of the United States. On the other hand, the US dominates the funding in Aerospace and BI industries, while China doesn’t exist. Moreover, France dominates the funding of Intelligent Systems and Energy industries in the market.

Top Geospatial Investors Distribution Across Countries by Total Funding:

Although we found that 57% of the total funding of the 568 companies is located in the United States, we realized that the top 3 investors in our data are located mainly in China. The largest investor with an investment exceeding $1.5B is Tencent, which is a world-leading internet and technology company that develops innovative products and services.

Tencent is investing around $1.203B in Momenta in China and around $373.8M in Satellogic in Uruguay. Although the Mercedes – Benz Group (previously Daimler) is a German company, we found that the company invests mainly in the Chinese market, specifically in Momenta, which is the largest funded company in our database.

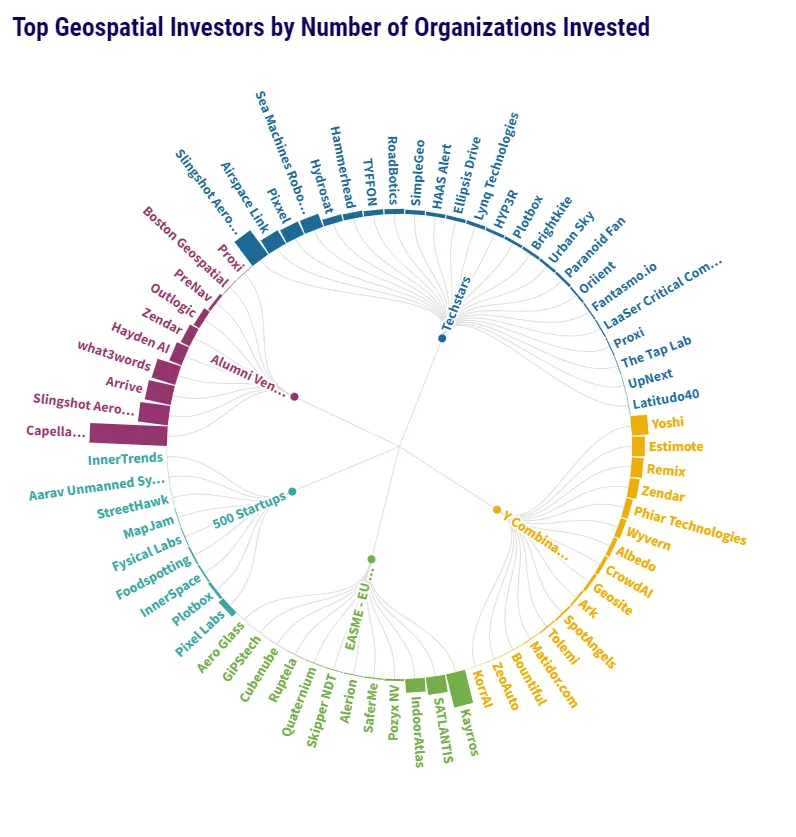

Top Geospatial Investors by Number of Organizations Invested:

In this radial chart, we show the top 5 investors according to the number of startups they are investing in. We found that 4 out of the 5 top investors are located in the US, while one is located in Brussels and related to the EU. This shows that the business community in the United States is interested in investing in various geospatial startups, and the investors are not limited to investing in exclusively big companies.

These numbers explain the superiority of the United States in the number of geospatial startups over the rest of the countries, where the number of startups in the US is 273, followed by 40 companies in China.

The largest investor in geospatial startups is Techstars, with 23 companies investing. This reflects the mission that the company declares to itself, which is supporting startups and connecting them to a network of successful mentors and partners.

Did you like the article? Read more and subscribe to our monthly newsletter!