Foursquare has spent the last few months studying how COVID-19 is affecting foot traffic across the United States. On April 30, the location intelligence company revealed the analysis of foot traffic trends from February 19, when community transmission of the novel coronavirus was first detected in the country, through April 24.

And what does that analysis tell us? That regardless of state-specific policies on the relaxation of coronavirus-related restrictions, people are feeling the itch to get back to the real world. While foot traffic had majorly bottomed out around the end of March, by April-end, upticks could be witnessed, indicating that consumer behavior is getting back to normal.

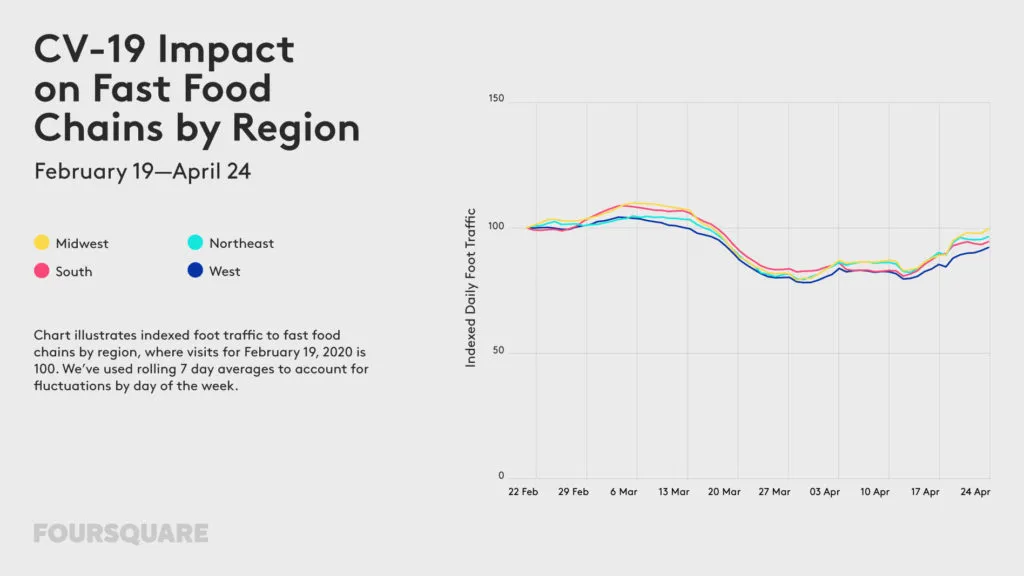

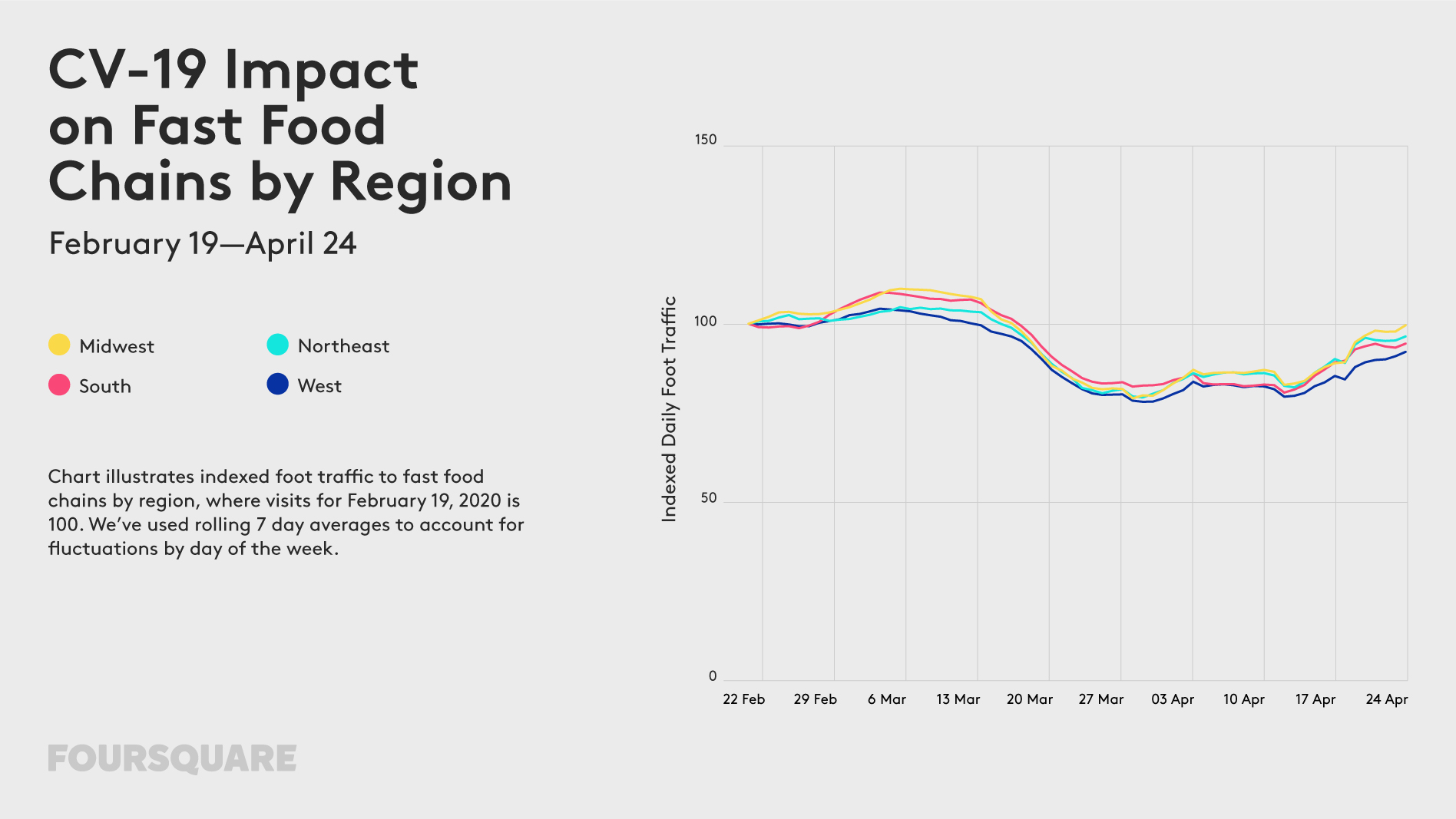

According to Foursquare data, fast food and gas station visits have returned to pre-COVID-19 levels in the Midwest and rural areas. Even casual dining restaurants are starting to show upticks, but that could also be prompted by new curbside takeaway options. Also, there has been a significant spurt in foot traffic to home improvement stores, which is a permissible destination in most US states.

These findings by Foursquare are based on anonymized and aggregated location data taken from the mobile apps of 13 million Americans who are a part of the company’s ‘always-on’ panel. “Men, and generally people between the ages of 35-64, have shown more moderate declines across different types of places, and are also showing greater propensity to return,” Foursquare explains in a blog post.

Let’s take a deeper look at the foot traffic patterns for QSRs, gas stations, grocery stores, hardware shops, trails, and offices.

Fast Food Chains: Foot traffic to quick-service restaurants (QSRs) has risen over the past several weeks, with traffic down only 5% nationally as of April 24.

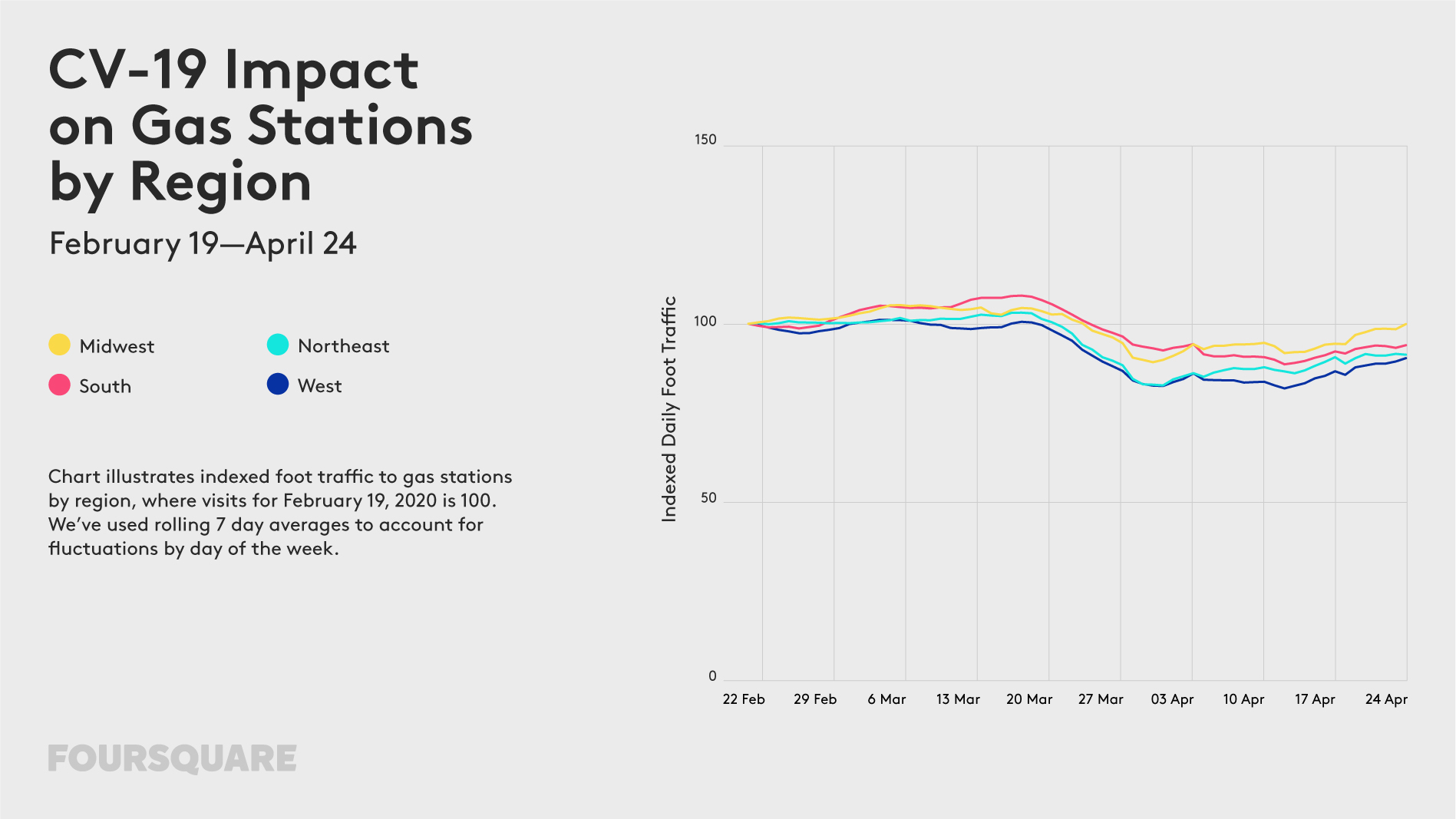

Gas Stations: Gas station visits have increased slightly since mid-April, down only 6% nationally as of April 24 (versus 8-11% in the weeks prior).

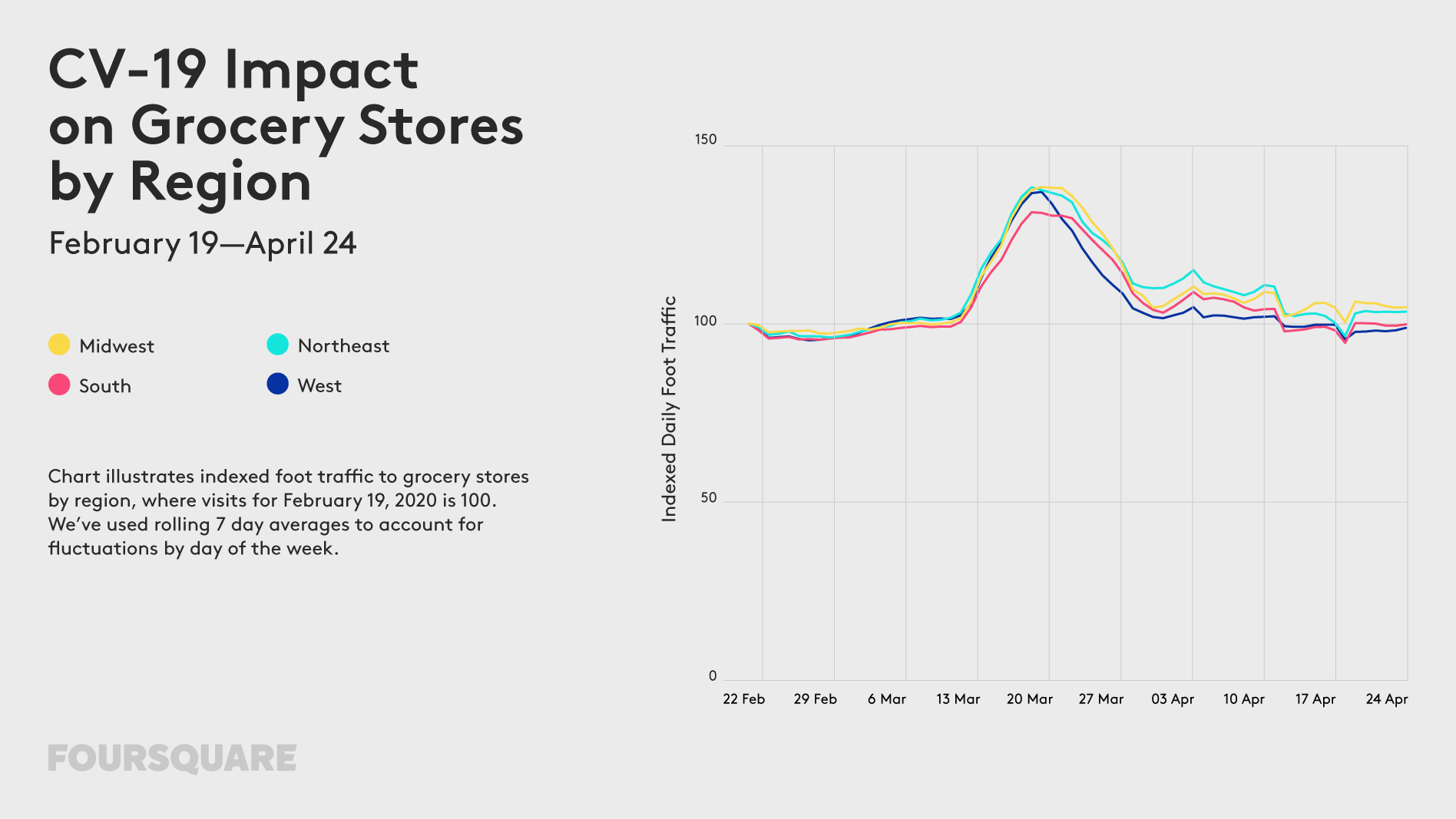

Grocery Stores: Surges in foot traffic to essential were observed in early to mid-March when consumers were in panic mode. This behavior settled down by March 23, as social distancing became the norm. Foot traffic has since returned to roughly normal levels.

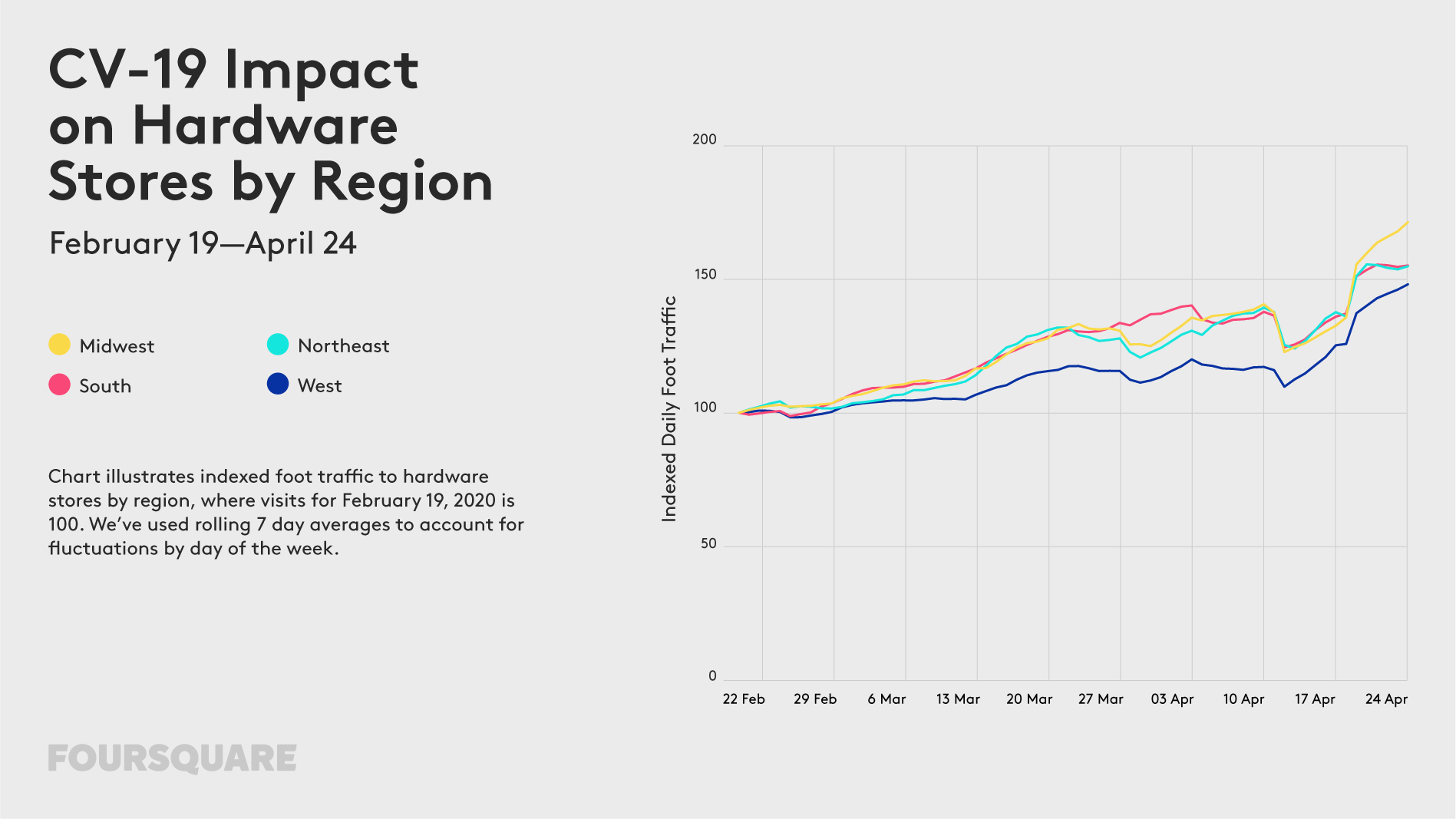

Hardware Stores: With people devoting more time and energy toward gardening and home improvement, foot traffic to hardware stores like The Home Depot and Lowe’s have increased significantly in recent weeks – with visits up 56% as of April 24.

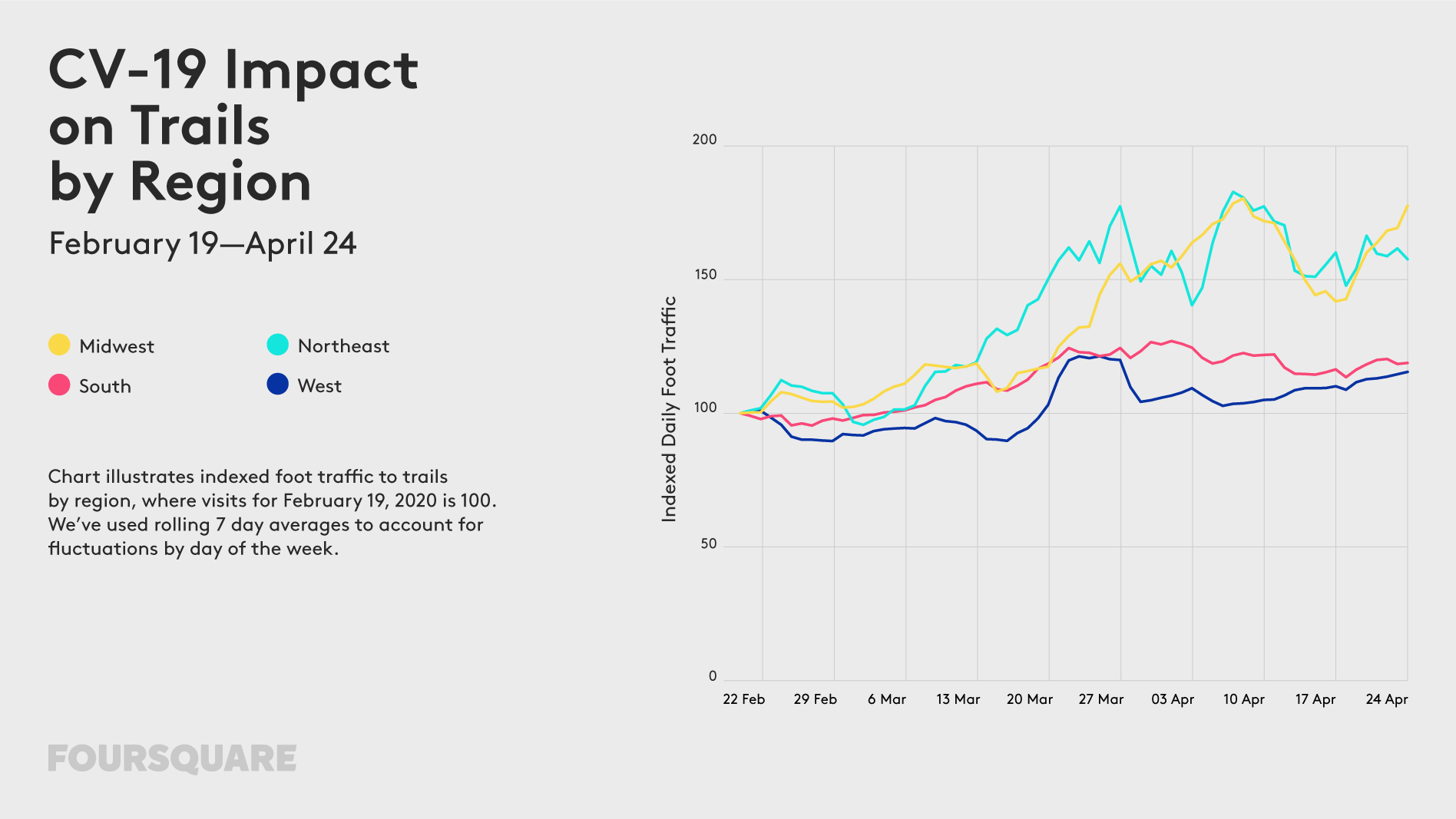

Hiking Trails: Trail traffic is up mostly in the Midwest (+77%) and Northeast (+57%). Although some of this could be due to seasonality, the growth in the last two weeks has been particularly notable.

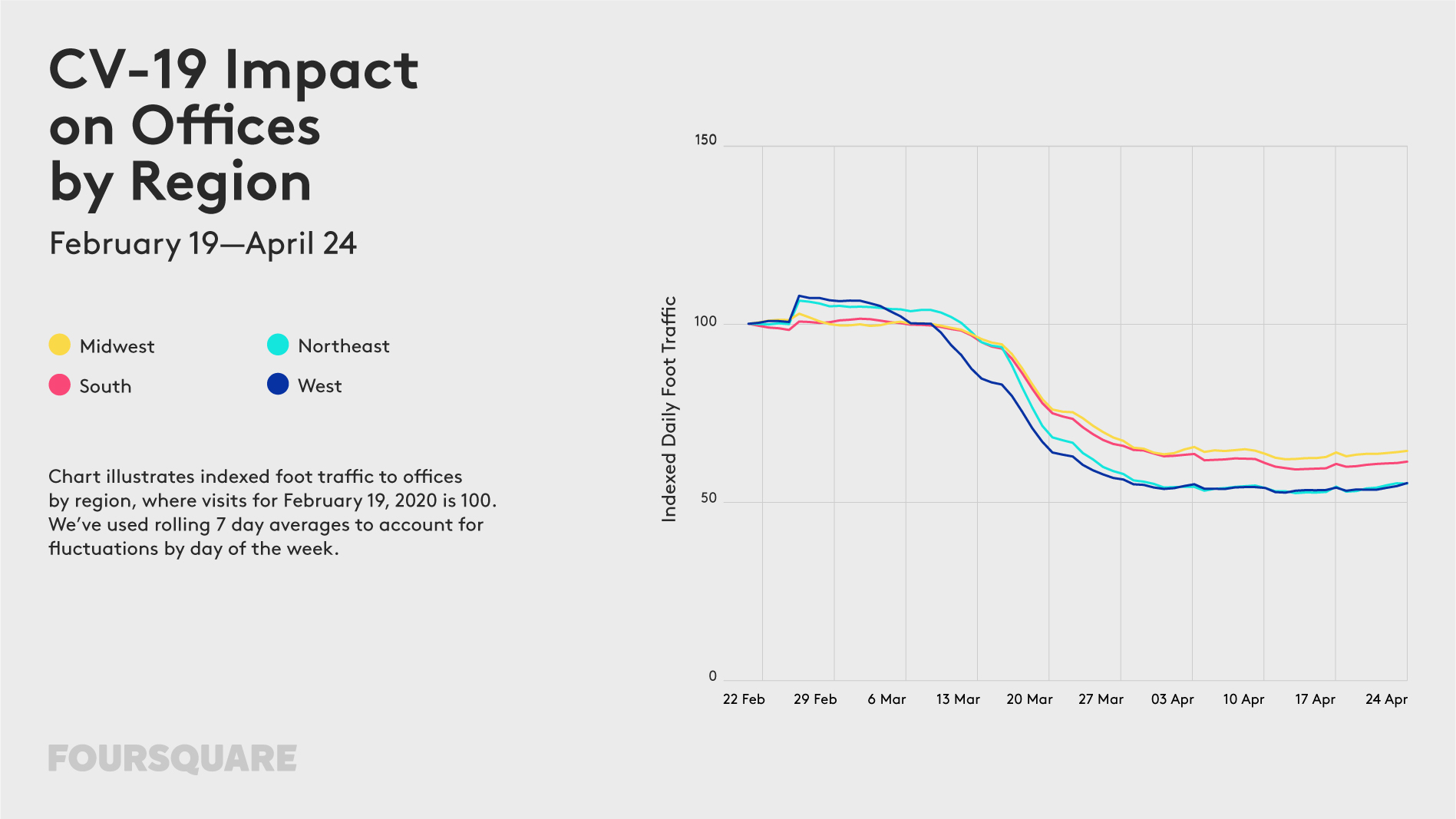

Offices: Foot traffic may be increasing elsewhere, but visits to offices have remained roughly stable since around April 1, down 40% nationally from the week ending February 19 to the week ending April 24.