Top trends driving the adoption of Earth observation data through 2023 and beyond

Satellite-based Earth observation data is no longer a niche technology, but rather a ubiquitous presence in today’s world. In 2022, it made headlines due to its crucial role in the global political landscape.

However, despite its widespread use by governments, the adoption of satellite data for wider applications has been slow—with notable exceptions in the agriculture industry, and in vegetation management for power and utility organizations. 2023 is poised to be the year when this trend takes a sharp turn, as more and more industries embrace the power of satellite data.

What’s causing this shift in the way Earth Observation data is used? There are several key factors, relating to changing business models within the industry, regulatory requirements, and advances in technology.

Regulation and reporting requirements

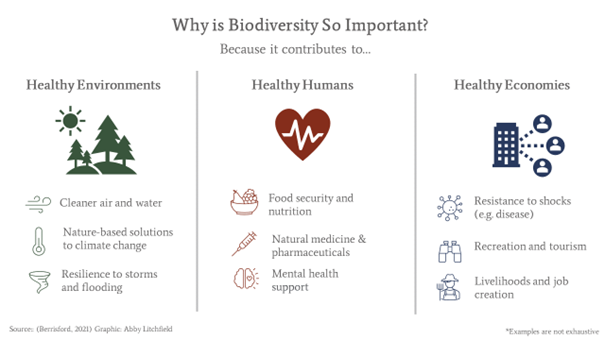

Many companies are now facing stricter laws when it comes to issues like sustainable supply chains and ESG reporting, with satellite data and analytics proving to be critical tools for monitoring and documenting compliance.

In 2021, new legislation was proposed by the European Commission to address global deforestation, and this is finally starting to have an impact this year. These regulations impose mandatory due diligence requirements on operators who market commodities associated with deforestation, such as soy, beef, palm oil, wood, cocoa, and coffee. Companies must gather geographic information on the land where their products were produced, with the aim of guaranteeing that only deforestation-free goods reach the EU market.

This development is likely to create a huge demand for satellite data for supply chain tracking, and there will likely be a proliferation of companies joining startups like SourceMap or Satelligence in this space.

In the realm of Environmental, Social and Governance (ESG) reporting, regulations are also driving the increased use of satellite data. Public companies are now required to publish their climate risk and ESG analysis together with their quarterly and annual financial reports. This space is still evolving, with organizations like the Task Force on Climate-related Financial Disclosures (TCFD) working to establish standards and metrics for non-financial reporting, but corporations are slowly waking up to the idea that Earth Observation and geospatial data can be key tools in the process.

Democratizing Earth observation data

The EO industry itself is also waking up to its shortcomings. Chief amongst these are a lack of standardization and a restrictive pricing structure. Dealing with these issues will remove barriers of technical feasibility and cost from multiple new use cases.

Data standardization

Diverse data standards are a significant bottleneck in the sector: Each vendor may claim to offer Analysis Ready Data (ARD), but significant technical challenges begin to arise when trying to combine data from different sources. Startups often spend a huge amount of time resolving issues with integration, rather than finding solutions for their clients.

The concept of ARD for geospatial imagery is not new. Guidelines for a minimum level of data processing and organization were developed and published by the Committee on Earth Observation Satellite (CEOS) back in 2019, but an official standard has never been established. However, this is about to change: From November to December 2022, the Open Geospatial Consortium (OGC) collected public comments on a proposed ARD Standards Working Group Charter, and will now bring it to life. The adoption of this standard from 2023 should dramatically improve the ease with which satellite data from different vendors can be combined, removing integration issues for existing companies and making EO data more accessible to a wider range of users.

New industry business models

Historically, legacy satellite providers have made enormous profits from government and military contracts, and have therefore been reluctant to change their pricing structure to prevent conflict with these key clients. However, these inflexible business models have long been seen as a hindrance to the widespread adoption of satellite data by the commercial sector.

Currently, the industry operates with a pricing structure of around $20-30 per km2 for 30cm data, with a minimum order of 50km2, which is simply not cost-effective for many applications—particularly any use case that requires frequent or cyclical operations.

The good news is this situation is changing, with legacy providers becoming more open to new business models—for example, blending their data into analytical products rather than just providing GeoTIFF image files via FTP. An increasing number of products and models such as this are likely to be introduced in 2023.

Technological tools increasing adoption of Earth observation data

It’s not just the ability to access and process satellite data which is important in geospatial analytics, it’s the ability to do it at scale.

Cloud-native architecture and integrations

In recent years, cloud-native architectures have become increasingly sophisticated and widespread, with Cloud-Optimized GeoTIFFs (COGs) and Spatiotemporal Asset Catalogs (STACs) becoming the tools of choice for organizing, storing, and sharing remote sensing data. This has made it much easier for organizations to use this data effectively on a large scale.

So too has the increasing integration of the EO ecosystem with geographic information systems (GIS) tools. One of the most successful examples of this trend is the recent integration between Esri and Up42, which allows users to easily request imagery from Airbus, Capella Space, Head Aerospace and other leading providers directly from ArcGIS Pro.

Advancements in Artificial Intelligence (AI)

Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are also driving the growing adoption of EO data. We can expect to see a continued increase in the use of these technologies, which enable real-time analysis of enormous data sets with greater efficiency and accuracy than ever before. AI tools can empower organizations of all sizes to utilize satellite data, which should lead to a proliferation of new, innovative solutions in the EO space.

New constellations Increasing affordability of higher resolution data?

Unfortunately, 2023 is unlikely to see a significant drop in the price of very high resolution (30cm or more) data, as the supply is still so low. There was an expectation that this would change with the launch of two new Pleiades Neo satellites in December, but they didn’t make it into orbit. However, the industry is still poised for growth, with the Maxar Legion 30cm constellation and Planet’s Pelican satellites both expected to launch in 2023.

The resulting increase in supply is expected to drive down prices and provide more flexibility for customers—albeit from 2024, rather than this year. The availability of data with a resolution of 30cm every 30-45 minutes for any location in the world will open up exciting new possibilities for the commercial sector; and the shift towards affordability will enable a wide variety of new use cases requiring high-resolution data at regular intervals.

A pivotal year for the industry driving growth for the next decade

2023 promises to be a landmark year for the satellite data industry, with a number of trends set to drive growth and adoption. The increasing flexibility of legacy satellite providers, coupled with a greater demand for accountability and transparency, will lead to the emergence of both new markets and new applications for EO data. Additionally, advances in technology and the increasing proliferation of higher-resolution satellite constellations will enable organizations to unlock new insights, driving innovation in the sector.

These developments all point to a bright future for the satellite data industry, setting the stage for growth in the coming years. In 2023, we can expect to see positive trends propelling the industry forward, and laying the foundation for a decade of progress.

Did you like the article? Read more and subscribe to our monthly newsletter!