EO-based detection of super-emitters

Editor’s note: This article was written as part of EO Hub – a journalistic collaboration between UP42 and Geoawesome. Created for policymakers, decision-makers, geospatial experts and enthusiasts alike, EO Hub is a key resource for anyone trying to understand how Earth observation is transforming our world. Read more about EO Hub here.

Methane (CH4) is a major component of natural gas and a strong greenhouse gas (GHG). Over the past 20 years, it has become 80 times more potent in warming the climate than carbon dioxide. When greenhouse gas enters the atmosphere, it acts as a mantle insulating the Earth. It absorbs energy and thus slows the rate at which heat leaves the planet. This process is referred to as the greenhouse effect and shapes the climate of our planet in a very significant way.

The Earth’s surface temperature is about 14°C. If it were not for the greenhouse effect, the average temperature of the Earth’s surface would be almost -20°C, and the Earth would be covered with ice all the way to the equator. However, with the increase in greenhouse gas emissions over the past few centuries, the greenhouse effect has steadily increased, contributing to the warming of our planet at a rate that many consider alarming.

Super-emitters are sites or facilities, typically in the fossil fuel, waste or agricultural sectors, that produce a disproportionate share of total methane emissions. According to a study of natural gas production in the state of Texas, 1% of natural gas production sites account for 44% of total emissions. Based on the study, the researchers found that emissions come from unintentional failures during natural gas development and production, which means that super-emitting sites have abnormal behavior.

With such large disparities in the output of harmful gas, control is key to preventing emissions and keeping them in check. This is because specific sites can be affected by abnormal conditions, resulting in them being super-emitters at different times. As a result, rather than trying to control emissions from several sites, minimizing emissions requires a monitoring approach that allows for effective and timely responses to the unpredictable nature of when and where a super-emitter will be located.

“Reining in methane emissions is key to limiting global warming,” according to NASA Administrator, Bill Nelson.

How to detect super-emitters using EO

At the COP26 meeting in Glasgow in 2021, following the release of the Global Methane Assessment (CCAC/UNEP) report, more than 100 countries signed the Global Methane Pledge. The signatories pledged to reduce methane emissions by 30% by 2030 relative to 2020. Implementation of the Global Methane Pledge could reduce projected global warming by 0.28°C by 2050. In addition, as indicated in the Global Methane Assessment, a greater reduction in emissions would also be realistic: 45% within a decade.

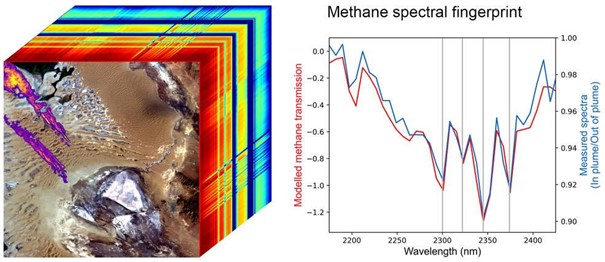

This raises the question of how best to control emissions to meet the target. Currently, verification of methane emissions can be done using satellites, which has the advantage of obtaining information quickly and globally. There are already several satellites and networks of satellites in orbit around the Earth that provide accurate emissions data. The satellites differ in their sensor parameters, including resolution, both spatial and spectral, recorded electromagnetic wavelength ranges, flight speed, etc. Methane concentration is not measured directly, but is obtained by analyzing and interpreting light intensity in different spectral ranges. Sensors, which use a band within the short-wave infrared spectrum, can detect methane. Methane absorbs infrared light in a unique way called spectral fingerprinting.

The cube (left) shows methane plumes over Turkmenistan. The colors of the rainbow are spectral fingerprints from the corresponding locations in the front image. The blue line in the graph (right) shows the detected EMIT methane fingerprint; the red line is the expected fingerprint based on atmospheric simulation. Credit: NASA/JPL-Caltech

NASA’s New Earth Space Mission

Initially, NASA’s Earth Surface Mineral Dust Source Investigation (EMIT) mission was intended solely to map the distribution of key minerals in the planet’s dust deserts. However, EMIT has demonstrated that it can also detect the presence of methane. In data that EMIT has collected since its installation on the International Space Station in July, the science team has identified more than 50 “super-emitters” in Central Asia, the Middle East and the southwestern United States. The newly measured methane hotspots – some previously known and others recently discovered – include extensive oil and gas facilities and large landfills. “This exciting new development will not only help scientists better determine where methane leaks are coming from, but also provide insight into how they can be remedied,” NASA Administrator Bill Nelson said. “The International Space Station and NASA’s more than two dozen satellites and instruments in space have long been invaluable in determining climate change on Earth. EMIT is proving to be a key tool in our toolbox to measure this potent greenhouse gas – and stop it at the source.”

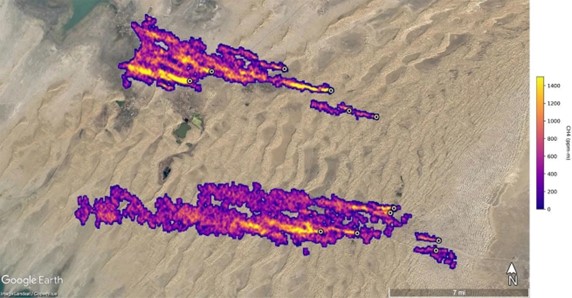

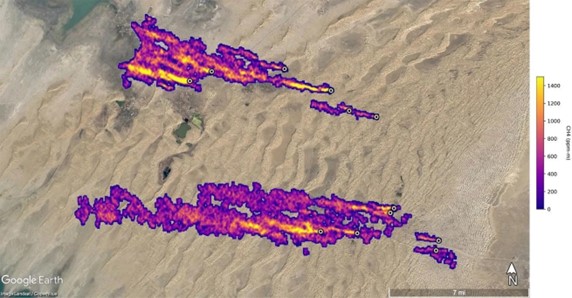

Orbiting the Earth every 90 minutes from its location aboard a space station about 400 kilometers high, EMIT is able to scan vast stretches of the planet tens of kilometers in diameter, while focusing on areas as small as a soccer field. “Some of the plumes EMIT detected are among the largest ever seen – unlike anything that has ever been observed from space,” said Andrew Thorpe, a Jet Propulsion Laboratory (JPL) research technologist leading the methane studies. An example is a cluster of 12 plumes from oil and gas infrastructure in Turkmenistan, with some plumes extending more than 32 kilometers. Scientists estimate that Turkmenistan’s plumes collectively eject methane at a rate of 50,400 kilograms per hour, rivaling the peak flow from the 2015 Aliso Canyon gas field explosion near Los Angeles, one of the largest accidental methane releases in U.S. history.

Super-emitters in Turkmenistan – 12 plumes of methane flux. The plumes were detected by NASA’s Earth Surface Mineral Dust Source Investigation mission, and some of them extend for more than 32 kilometers. Source: NASA/JPL-Caltech

“As we continue to explore the planet, EMIT will look at places where no one thought to look for greenhouse gas emitters before, and find plumes that no one expects,” Robert Green, EMIT’s principal investigator, said.

Organizations and start-ups supporting methane detection

There are several organizations and startups that focus on detecting emissions of harmful greenhouse gases and super-emmiters, including methane. Importantly, all of them use their specialized satellites for this purpose. Worth highlighting here are:

GHGSat – satellites from a private company offering data for the oil, gas, coal mining, waste management, and financial and public institutions sectors, as of 2016.

MethaneSAT – a satellite funded by the US NGO Environmental Defense Fund and the New Zealand Space Agency.

Carbon Mapper – a public-private project of NASA’s Jet Propulsion Laboratory.

GeoCarb – geostationary satellite, a joint initiative between NASA and the University of Oklahoma, among others, scheduled for launch in 2023.

Copernicus Sentinel-5 Precursor – a satellite of the European Space Agency and the European Commission.

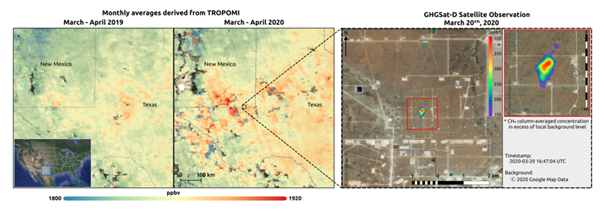

To obtain precise information about the location of an emission point, each company uses its own methods, and combines available technologies. For example, the SRON and GHGSat research teams have been working since early 2019 to detect methane hotspots. The SRON team uses data from the Copernicus Sentinel-5P satellite to detect super-emitters on a global scale. The GHGSat team then uses data from the GHGSat satellites to quantify and attribute emissions to specific sites around the world. Their work has led to the discovery of several new hot spots in 2020, such as above a coal mine in China. The team also detected methane emissions over the Permian Basin, the largest oil-producing region in the United States.

Another method was to combine data from two missions: Copernicus Sentinel-5P and Sentinel-2 using artificial intelligence algorithms. As a result, Kayrros specialists detected 13 methane emission events in 2019-2020 along the Yamal-Europe pipeline, which runs through Russia, Belarus, Poland and Germany, over a distance of 4196 kilometers. They also estimated that one leak dumped as much as 93 tons of methane every hour.

Both findings confirm the need for constant emissions control. Undetected methane leaks from the energy industry are a global problem – and a serious one. A lot of useful data is available for anyone interested in doing their own analysis. Companies like UP42 are also helping to raise environmental awareness by distributing environmentally important data – available to anyone.

Conclusions

When one hears about global warming, by far the most prevalent material is about the fight against carbon dioxide. However, reducing methane emissions is also very important, because methane has a stronger warming effect in the short term than CO2, and reducing methane emissions would have a more direct effect on the climate. Methane accounts for about 30 percent of the increase in global temperature since industrialization, and emissions rose to record levels for the second year in a row last year. In addition, super-emitters can increase emissions by as much as dozens of times, relative to average emitting facilities or equipment. This is therefore a huge problem for both the environment and us humans. The only way to stop this process is to limit emissions. But the key here is control and accurate detection of super-emitters. Satellite technology, which has been active in this area for several years and is constantly developing in the industry, is invaluable here. It is only with the use of EO that we are able to control the changes taking place around the world so quickly and virtually in real time.

Did you like the article? Read more and subscribe to our monthly newsletter!