Most of us are more or less aware that in the era of the digital, connected world, where all of us are online 24h a day via smartphones, we generate a lot of data which we are seamlessly sharing with companies, governments and individuals. When it comes to our location data, we’re already used to sharing it for the common good of all drivers by using apps like Waze, where we consciously crowdsourced our geographical position to let other drivers smartly avoid traffic jams. Most of us are also aware that whenever we use real-time traffic apps our location is used as traffic probe data by companies including Google, TomTom, HERE and others. We also suspect that Google tracks our position (check Google Location History website) to provide us with more targeted and therefore effective location-based ads.

WE ARE ALL LOCATION PROBES

But what most of us don’t realise is that similarly to how navigation apps providers use our data to provide traffic services, wireless carriers track our location 24h a day and sell it to 3rd party companies. And according to JDSU (one of the players of that industry), the market of these so-called Location Insight Services will be worth $11 billion to mobile operators by 2016. That’s a lot of money.

HOW DOES IT WORK?

What kind of location data do Wireless Carriers actually have? Imagine that whenever your mobile device has reception it means that you are connected to a cell phone tower (so-called Base Transceiver Station or BTS). When you move by a distance longer than a few hundred meters in the city and a few kilometres outside the urban area, you’ll switch between BTS. In that way our position can be constantly tracked, no matter if you have iPhone 6 or an old feature phone. The data is then anonymised, aggregated and sold to third-party data analytics companies.

What kind of location data do Wireless Carriers actually have? Imagine that whenever your mobile device has reception it means that you are connected to a cell phone tower (so-called Base Transceiver Station or BTS). When you move by a distance longer than a few hundred meters in the city and a few kilometres outside the urban area, you’ll switch between BTS. In that way our position can be constantly tracked, no matter if you have iPhone 6 or an old feature phone. The data is then anonymised, aggregated and sold to third-party data analytics companies.

MANY START-UPS ALL AROUND THE WORLD

For example, AirSage, a company founded in 2000 in Atlanta, GA, has spent much of the last decade developing the technology and negotiating rights to put its hardware inside the firewalls U.S. wireless carriers to collect and analyse cellular tower signalling data in real-time. Over the years AirSage has found its niche in the transportation planning and modelling for US cities.

But AirSage also resells its data. One of their customers is a San Francisco – based start-up called StreetLight Data founded by Laura Schewel – a PhD at the University of California, Berkeley who specialises in transportation research. StreetLight specialises in adding additional layers of information beyond cellular network data. It combines it with GPS-based traffic data from INRIX and US census layers to provide custom-made analyses for different customers.

Also, the U.S. branch of GfK – well established global market research company has launched its product called GfK Location Insights where it claims to combine its rich demographic and geomarketing databases with cellular behavioural data.

There is also a lot of business happening outside the US. A Czech company called CE-Traffic specialises in providing spatial crowd analytics for mass events. Such data are of a big value especially for publicly available events where it would be impossible to track the number of people in any other way.

The power of data from cellular operators lies also in the fact that all foreigners in a particular country are logged in to the networks via roaming services revealing their country of origin (or at least the country of origin of their cell phone). Positium – Estonian start-up has developed a bunch of products to monitor tourism behaviour based on that kind of data.

Data about outdoor foot traffic are especially interesting (and hard to measure in any other way) for the outdoor advertising industry. How to find out how many people have seen particular billboards? This is the question that HERE, the mapping division of Nokia, is trying to answer with their new billboard analytics platform.

WIRELESS CARRIERS DON’ STAY BEHIND

But of course, wherever their huge money is involved, big players on the market will not stay behind for a long time. The leading role in that market has been established by European carriers. In particular the French headquarters of Orange telecom, which has launched their first GSM-based real-time traffic service back in 2008. Orange has been very active in the location-based Big Data industry since then. In 2010 the company has launched the first of its Big Data challenges where it would give massive datasets to teams of developers from all around the world. For example, in the 2013 Challenge edition, the telecom released 2.5 billion call records from five million cell-phone users in Ivory Coast gathered between December 2011 and April 2012. 83 projects have been submitted and 4 had won prizes including IBM project about re-modelling bus routes.

The value of such data for researchers is really huge. In 2011 MIT launched a research lab project called Senseable City Labs where it gathers scientists from all around the world to work on unleashing the full potential of Big Data. Its scientists have worked on a lot of amazing projects including projects to understand the spread of diseases or analysing the poverty levels and ethnic divides based on mobile signalling data, on top of other research.

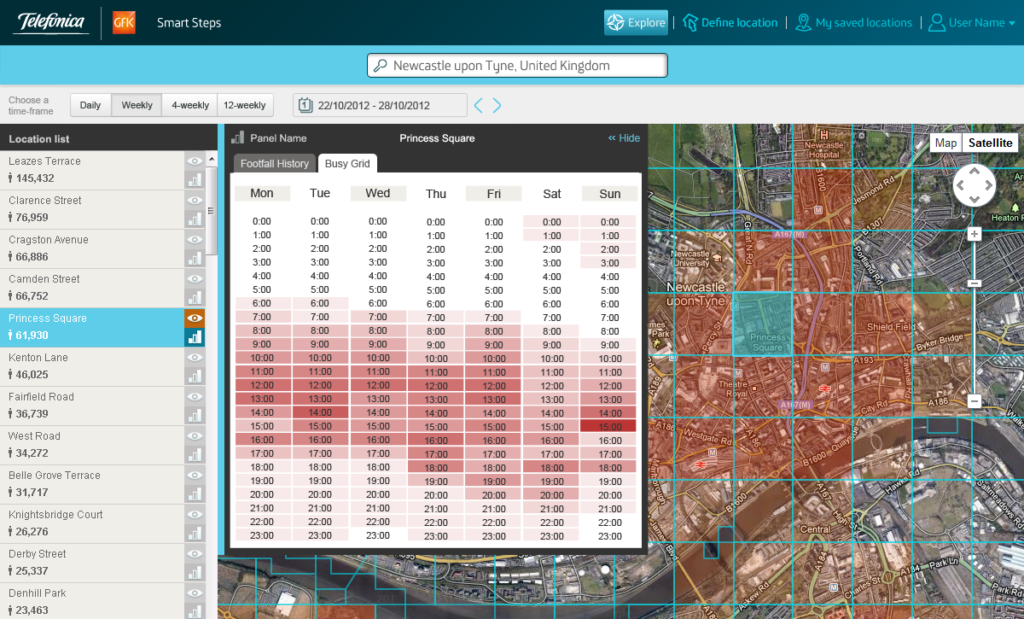

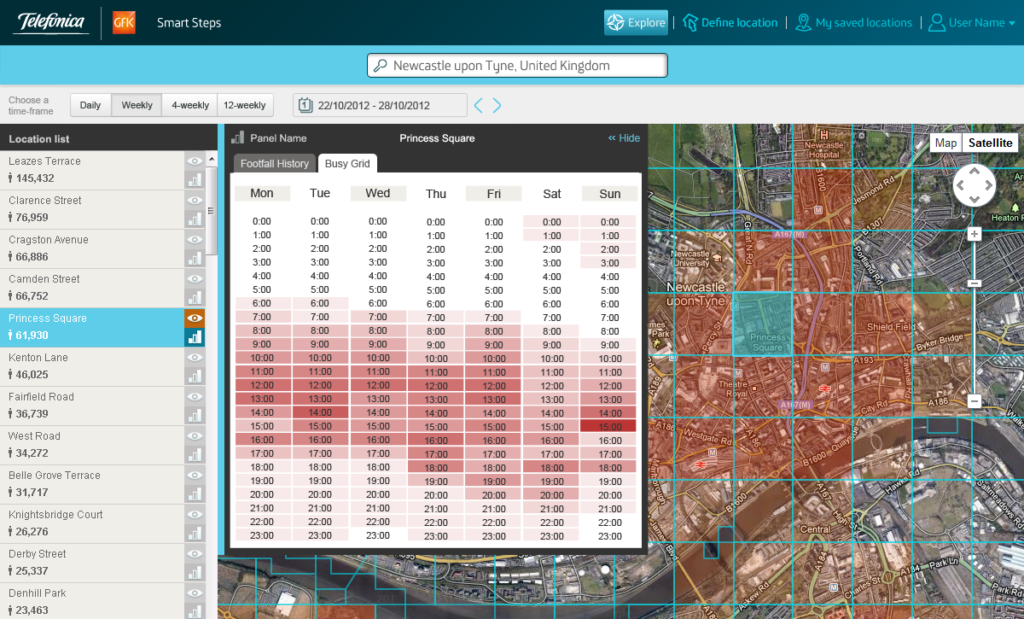

But it’s not only about the research. Other European carriers are also looking closely into this market. In October 2012 Telefonica launched a program called Dynamic Insights which is a new global business unit, dedicated to identifying and unlocking the potential opportunities for creating value from ‘Big Data’. It has been officially announced at a new industry conference on “big data monetization in telecoms”.

The first product of the new department is called Smart Steps and it looks quite promising.

Also European T-mobile’s innovation unit T-systems offer their custom-made wireless Big Data solutions but rather for internal customers (T-mobile branches from all around the world).

Telecoms in the U.S. are also joining the race to win the Location-Based Big Data market. Verizon Wireless has launched Precision Market Insights where it combines the virtual data from mobile devices and Big Data including location data. It is a natural extension of what already happens online, with websites tracking clicks and getting a detailed breakdown of where visitors come from and what they are interested in.

PRIVACY OF USER DATA

I believe that after reading this article so far the main question you have is related to data. The data sold by wireless carriers include location points (determined by the nearest cell tower) and anonymised identifier of your phone number which will not reveal your personal data but it will allow for the identification of a unique phone in a particular location. The fact is that as long as your “personal” data is stripped out, Telcoms are allowed to sell the anonymized data to whoever they want.

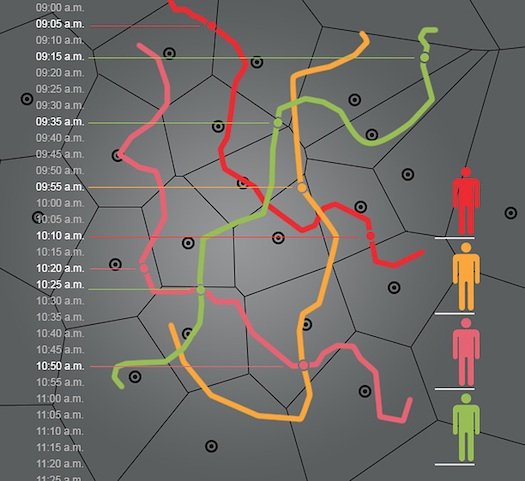

Tracking your location!!

Rendering by Christine Daniloff/MIT of an original image by Yves-Alexandre de Montjoye et al.

The problem is, the data may not be anonymous after all. A group of MIT researchers found a way to work back to 95% of people just from four location data points of a person. Of course, such backwards engineering is illegal but its possible. On the other hand, we must remember that wireless carriers and companies who buy such sensitive data do care about avoiding lawsuits on their hands.

There are several aggregation techniques used by different companies. AirSage for example limits their population queries to a minimum of eight people, broken out by census block. StreetLight Data limits it to 15 individuals. The popular approach is aggregating traces of movements of people into patterns. Another way is analysing common locations that might indicate the home, work, or school of an individual and then aggregating it based on spatial location units (e.g. grid 500×500 meters).

Most worrying of all, the tradeoff between privacy and utility is taking place behind closed doors. The strength of the de-identification tools is usually specified in the contract between the carrier and third-party buyers but there are no specific laws that could control it.

Also, the approach of carriers to their user privacy is not specified enough in different countries. When you sign an agreement with some telecoms you are by default allowing the carrier to share your location with anyone they want, and you need to opt-out from such a service on demand. Fortunately, some networks like Verizon allows customers to opt in to (rather than opt-out of) in return receiving deals and offers.