How satellites assist wildfire management

How has the number of fires changed over the years, and why is it a growing problem?

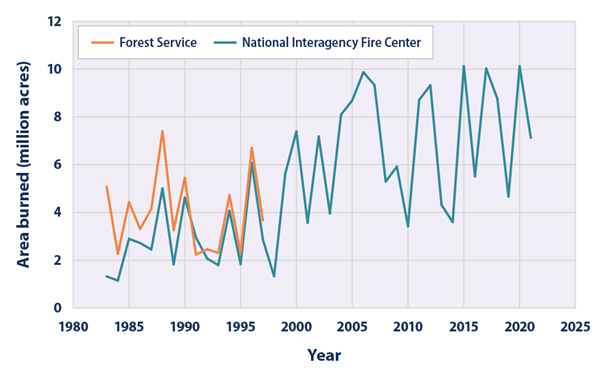

Fires are increasingly posing a significant threat each year, impacting not only remote areas but also inhabited regions, endangering homes, possessions, and even lives. This escalating issue affects the entire world, and the United States serves as a prime example of the growing prevalence of large-scale fires, fueled by climate change. Since 2000, the US has experienced an annual average of 70,072 forest fires, burning approximately 7 million acres – more than twice the 3.3 million acres burned yearly in the 1990s, despite having more fires per year. Experts concur that ongoing greenhouse gas emissions intensify climate change, leading to increased surface temperatures and altered precipitation patterns, exacerbating the fire situation.

Annual wildfire-burned area from 1983 to 2021 in US, Source: https://www.epa.gov/climate-indicators/climate-change-indicators-wildfires

“Climate change is creating ideal conditions for larger, more intense fires,” said Robert Scheller, a professor of forestry and environmental resources in NC State’s College of Natural Resources, who uses geospatial analysis to study the effects of climate change and human activities on the long-term health of the landscape. “We’re already seeing fires that we didn’t expect to see until 2080.”

As of 2021, the average surface temperature of the United States was about 2.5 degrees Fahrenheit. Experts expect this figure to increase by 3 to 12 degrees Fahrenheit by 2100. This will result in more intense and frequent heat waves, while reducing rainfall in some areas. These conditions will make droughts worse, making landscapes across the country more flammable.

Fire monitoring is crucial for early detection, prediction, and firefighting, with satellite data providing invaluable assistance

For both humans and the natural world, wildfires are a huge ecological disaster. They negatively affect the soil cover, the forest stand, the atmosphere, and the animal world. It only takes 50°C for valuable and protected plant species to perish, while during a wildfire the soil temperature reaches 700°C. Navigating through the forest can be very difficult, and finding the location of a fire is time-consuming. These are additional minutes and sometimes hours that allow the flames to spread. To ensure that these fires do not endanger people and animals, it is extremely important to observe the first moments after the fire is lit to identify its exact location, speed and direction of spread. Unfortunately, firefighters who are on the scene do not always have the ability to accurately calculate these factors. Also, scientists cannot accurately estimate the extent of the damage without high-quality statistical data showing the size of the fire and its location. This is why the success of forest fire risk mitigation largely depends on the amount of information available and the speed of decision-making. Monitoring is crucial for effective fire management and detecting fire outbreaks as soon as possible.

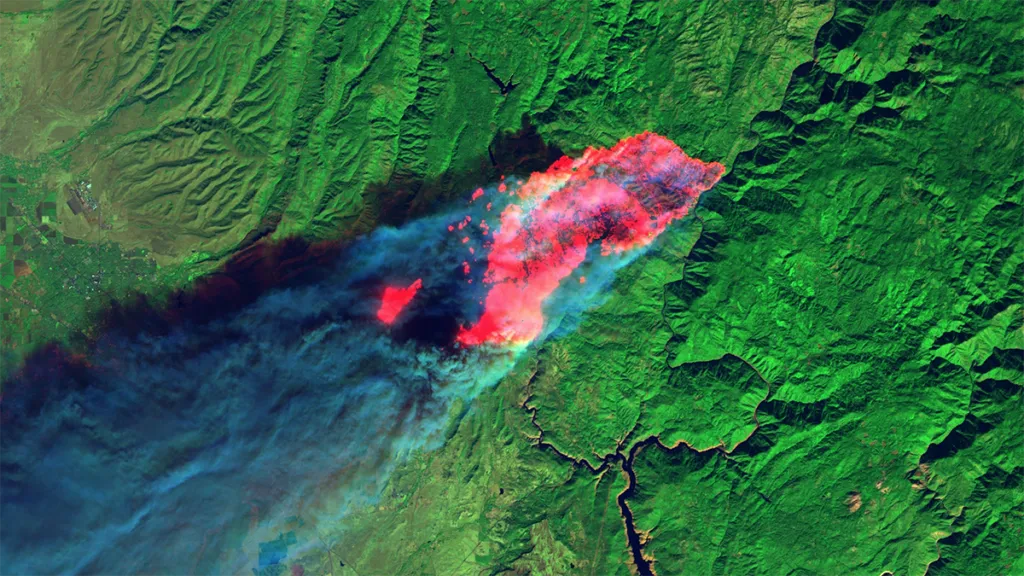

Without a doubt, satellite imagery is one of the best tools for monitoring wildfires, using innovative remote sensing technologies to provide cost-effective, timely solutions. Satellite images and weather data help to assess the current situation and the affected areas, and when combined with algorithms, satellite data can also help predict the course of fires. This will assist firefighters to control the spread of fires, and potentially reduce damage.

WildFireSat – a wildfire management solution with a Canadian example

Eighty-eight percent of Canada’s 4 million square kilometers of forested land are boreal forests, which have some of the largest and most intense wildfires in the world. Each year in Canada, some 7,500 fires consume more than 2.5 million hectares of forest, a territory nearly the size of Belgium.

The planned WildFireSat mission aims to monitor daily, from space, all active forest wildfires in Canada. In a country as vast as Canada, observation from space is the only way to obtain daily information on all active forest wildfires with the necessary precision. The main goal of WildFireSat is to support the management of wildfires, studying their behavior and the emissions of carbon, aerosols and other particles produced by fires.

The system’s satellites will be equipped with infrared sensors designed to measure the energy emitted by forest fires. This energy is referred to as Fire Radiative Power (FRP), which makes it possible to determine the characteristics of forest fires and their features, such as rate of spread and intensity. In addition, accurate data on carbon emissions from fires will be acquired, which is an important requirement of international agreements on carbon reporting. WildFireSat will also provide Canadians with precise data on air quality and smoke conditions. The mission will work with existing satellites to greatly expand our knowledge of forest fire behavior, and how that behavior is changing with our climate.

It’s also worth noting that losses due to fire can be reduced by improving the ability to make informed decisions, thereby defending communities and avoiding unnecessary evacuations. This will help to better protect both infrastructure and the environment, especially near populated areas. In addition, the measures will help to reduce health problems associated with smoke and air pollution.

The #WildFireSat mission will increase Canada’s ability to monitor #wildfires, providing faster, more accurate, information for air quality forecasting. https://t.co/TXCmWqdoNX

— Environment Canada (@environmentca) August 30, 2019

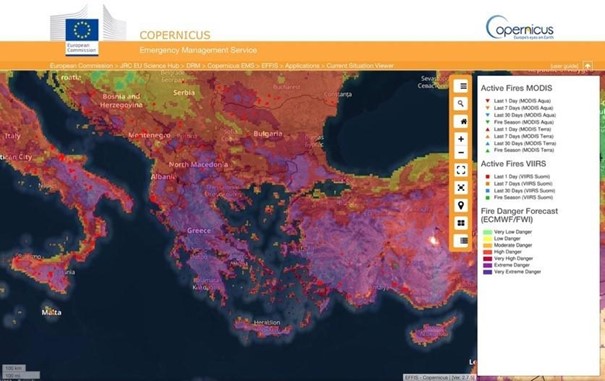

Emergency management services of the Copernicus CEMS program

Copernicus CEMS provides a free and open access global emergency mapping service. Users can get information about a disaster event at a scale, timeline and perspective that can only be obtained with geospatial information. This gives us the ability to analyze changes across the Earth over days, weeks, months or years. Products can be quickly shared with all agencies involved. This contributes to consistent and timely emergency response. CEMS deals not only with fires but all natural disasters (floods, fires, earthquakes, tsunamis, volcanic eruptions, landslides, storms, droughts, etc.), as well as man-made hazards (industrial accidents, oil spills, etc.). The area of observation extends beyond the European Union.

CEMS offers nine service components that cover every phase of the disaster and risk management cycle. Most of the CEMS components operate 24 hours a day, seven days a week, year-round, and those relevant to firefighting include:

– Rapid Mapping – provides print-ready maps and digital geospatial data sets within hours of a disaster to quickly visualize the scope and impact of an event.

– Risk and Recovery Mapping – supports preparedness, prevention and recovery of affected areas.

– European Forest Fire Information System (EFFIS) – monitors forest fire activity in near real-time. EFFIS supports the management of forest fires at national and regional levels in EU member states and in the Middle East and North Africa.

A number of applications are available through EFFIS, such as the Current Situation Viewer, Current Statistics Portal, and Wildfire Risk Viewer, among others. All applications are available here.

EFFIS Current Situation Viewer

NASA’s Fire Information for Resource Management System (FIRMS)

NASA’s FIRMS and Worldview tools provide active fire data within three hours of observation from Earth-observing satellites to users around the world. Active fire and hotspot data can be viewed in FIRMS Fire Map or NASA’s Worldview, delivered as email alerts or downloaded in the following formats: SHP, KML, TXT or WMS. Since summer of 2022, data for active fires on the continental United States are also available in real time (within one hour of satellite observation) and in ultra-real time – within one minute – using direct transmission data and new software developed by the Space Science and Engineering Center (SSEC) of the University of Wisconsin-Madison.

“The more recent the data, the higher its value in assessing the location, extent and intensity of newly detected fire activity,” said Brad Quayle, manager of the Disturbance Assessment and Services (DAS) program at the USDA Forest Service. In addition, Everett Hinkley, manager of the National Remote Sensing Program at the U.S. Forest Service’s Office of Geospatial Management, added, “FIRMS gives us ‘at-a-glance’ knowledge of where wildfires are and where the active wildfire area is … In some remote areas, it is our only window into what is happening with wildfires and allows us to track their development.”

FIRMS has active fire data acquired from the Visible Infrared Imaging Radiometer Suite (VIIRS) instruments onboard the Suomi National Polar-orbiting Partnership (Suomi NPP) satellite and the Moderate Resolution Imaging Spectroradiometer (MODIS) instruments onboard NASA’s Aqua and Terra satellites.

It is also worth mentioning that FIRMS is part of NASA’s Land, Atmosphere Near real-time Capability for EOS (LANCE). Diane Davies, operations manager for LANCE, notes that in addition to information on active fires, “LANCE provides a wide range of data and near real-time imagery from NASA and other scientific satellite missions to help users monitor hazards and disasters, including wildfires, smoke, air quality, dust storms and floods.”

Conclusions

Satellites use innovative technologies that have a lot of potential when it comes to wildfires. Remote sensing from wildfire satellites can help forest managers identify burned areas, classify burn levels and estimate the total area burned, as well as acquire accurate data on carbon emissions and environmental pollution. With remote sensing, we can obtain measurements of many different wildfires and determine their size, location, duration and temperature, data that would be unavailable without the use of satellites. In addition, current wildfire detection satellites can identify wildfires before they are observed on the ground, which is often 10-15 minutes before an emergency call arrives. Therefore, monitoring forest wildfires using earth observation data is critical.

Did you like the article? Read more and subscribe to our monthly newsletter!