Climate change and the environmental impact of industrialization are definitely two of the biggest challenges facing humanity today. Thanks to Landsat program, Copernicus program, Indian Remote Sensing (IRS) satellite program, among other national earth observation programs and not to forget the commercial EO data providers like Digital Globe and Planet is getting easier and easier for us to analyze remote sensing data to have a data-driven understanding of the impact that industrialization is having on our environment and one startup that is doing some really interesting work in that area is Satelligence.

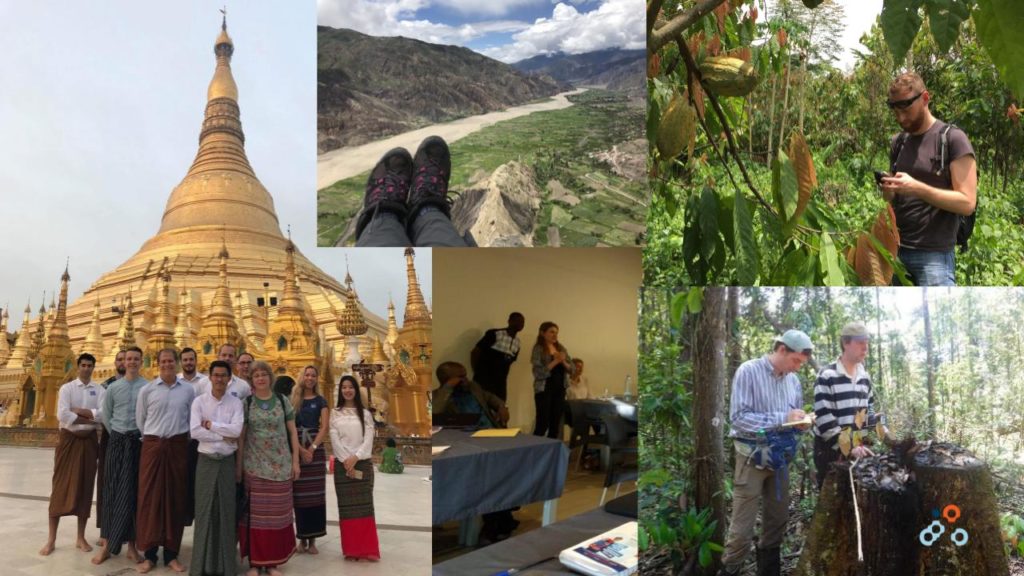

Satelligence was started in 2016 with the mission to change the world for the better, using satellite data, in areas where it matters most. They create actionable information for applications such as commodity supply chain monitoring and financial investment planning. Enabling their clients to feed the world while protecting its natural resources: rainforests, biodiversity, and carbon stores.

I had the pleasure of talking with Arjen Vrielink, the co-owner of Satelligence to learn more their vision, their team, business model, the tools they use and more. Enjoy 🙂

Q1: Arjen, you have been working in the geospatial industry in various roles for more than a decade now. What made you take the leap of faith and start a company that tackles deforestation?

A: The leap is what happens in the mind. Mentally it’s quite a step from being an employee gathering skills and getting more experienced. In reality, joining Satelligence as a director co-owner was a logical, even small, step. During my entire career, I worked with wonderful, very talented people so I always knew that technically we could take on any problem that would cross our path. However, since quite recently, I would say two major developments made having a business economically viable:

- Two major repositories of free as in beer data: NASA (Landsat & MODIS) and EU Copernicus (Sentinel programme), with a guaranteed lifetime of 10 years or more.

- A shift in cultural stance and the following corporate position on sustainability. Sustainability is moving from an annoying liability (think PR-risk) for companies to a strategic asset. Companies realise (environmental) sustainability is something that helps them create long term economic sustainability. Sustainability is moving to the core of companies (think Paul Polman of Unilever or the b-team).

Those two developments allow us to build a company with technically excellent products which make sense to our users at an affordable price. And that is what was missing in the equation until really a few years ago when remote sensing companies with an environmental mission had to rely on government subsidies, world bank programmes or NGO funding.

Q2: Satelligence was started with the mission to reduce deforestation due to commodity production to zero. Zero deforestation sounds really uplifting! But how does this work? Who is your target client – is it environmental agencies, companies that source commodities, local farmers?

A: Zero deforestation is the ultimate goal we pursue. It’s the purpose of our company in a concrete sense. In a broader sense we advocate the use of remote sensing for natural capital to benefit society and environment. To reach deforestation we believe you need an integrated approach. You cannot target one group of ‘bad guys’ and simply tell them to stop cutting down the forest. It’s a complex problem. That’s why we like to work with organisations that have a common goal. That used to be environmental NGOs (WWF, Greenpeace, AidEnvironment, Wild Asia) and government agencies and is now moving towards the big players in commodity value chains such as palm oil: producers, traders and consumer goods companies.

Q3: It is great to see corporates care about the environment. How does your startup help them tackle the issue of deforestation due to commodity production?

A: What we do is listen. Good communication is not about speaking but about listening. So we talk to our clients, listen to their requirements and concerns, try to understand their day to day workflows and adapt our deforestation alerts to that. What you see with for example Global Forest Watch and/or the GLAD alerts is that, technically, they are really good at what they do and they do provide data on deforestation. But for a lot of companies, it’s an overload of data, there’s alert fatigue and/or the companies lack the technical tools and skills to process the data in their workstreams. We listen to the companies and give them what they need, when they need it and provide them with the information they can immediately act upon. This is step 1: reacting as fast and efficient as possible to actual deforestation. The next step would be preventing deforestation. We are working on forecasting models where we identify high-risk areas that are prone to deforestation.

Q4: Your team has been working extensively in Southeast Asia – in Myanmar and quite recently in Malaysia. Could you tell us a bit more about your work there and how it helps the local community there tackle deforestation?

A: For oil palm, we work mainly in Indonesia and Malaysia. What we do is provide our clients with the latest insights on deforestation in and around their sourcing areas. The client then acts upon alerts by validating them and, if needed, take action. There are a few cases where a client pushed a stop work order to one of their sourcing providers because they didn’t comply with the zero-deforestation policy.

Q5: Was it hard to convince corporates about the economic value of your platform and solution? What is your business model? Analytics as a service?

A: Our business model is a subscription based service. Companies pay a yearly fee based on the acreage of the area monitored. They receive up to 40 alert updates per year for that, depending on satellite availability and coverage. They receive the updates via our platform and/or as a bulletin in pdf in their inbox, depending on their needs. It depends on the commodity if corporates are ready to pay for our service. For palm oil for example, the market is ready and we see all the big players shopping for some deforestation monitoring solution. For soy in South America, we see a much more wait-and-see stance as the companies don’t feel the pressure so much yet.

Q6: Using satellite analytics to monitor deforestation and commodity production on a global scale must be quite challenging. What was the biggest engineering challenge in building such a platform?

A: Interestingly enough that would be having a reliable and fast upstream link to the satellite data providers. Our main satellite data sources are Landsat and Sentinel 1 and Sentinel 2. Amazon and Google have buckets where they mirror the archive of Landsat and Sentinel 2 which is great for us because it’s a fast and reliable repository. The problem is Sentinel 1. There is no cloud provider (that we know of) that provides the S1 archive so we have to rely on downloads from Copernicus. That works but is really slow and a beast to scale (max 2 parallel downloads per registered account).

#GeoDev Do you know if there is a cloud service provider that provides an archive of Sentinel 1 data?

Our friends at @SatelligenceEO are currently downloading the data from the #Copernicus website but it’s apparently not as fast as one would like

— Geoawesomeness (@geoawesomeness) January 23, 2019

Recently the Copernicus DIAS initiative took off so we are exploring if on of the DIAS providers could give us the uptime and bandwidth we would like to have. On another level, upstream providers are still a long way from reliable, operational services: unannounced downtime, unannounced changes in (filename) formats, the threat of US government shutdowns. Lots of ducktape in our codebase to work around those kind of issues.

Q7: Could you tell us a bit more about your tech stack? What programming languages and technologies does your team use?

A: Our goto language is Python. We love it, geospatial community loves it and the scientific community loves it. And the major tech/cloud providers also love it. Major players in our stack: Kubernetes and Docker for deployment, orchestration and service scaling, Python, GDAL/OGR for geospatial credibility (if you don’t use this library and you’re doing geospatial you don’t take yourself seriously), Numpy and SciPy for multidimensional array processing in Python, Dask to scale Numpy, PostGIS as our vector engine (we use Django as an ORM and for the admin pages), Scikit-learn and XGBoost for machine learning and then some.

Q8: Most of your team have an educational background in geomatics and remote sensing (including yourself). Was it a conscious decision to hire geo experts? What advice do you have for students studying geomatics and other related courses?

A: Apart from geomatics and remote sensing our team would be educated in the environmental sciences (and astronomy). We do that because we strongly believe, even, or especially, for customer relations, business development and sales, that a workforce that knows what they are talking about, understand the complexity of the domain (technically but also socially, economically, politically and historically) results in a better service and thus happier client.

My advice to geomatics students would be to focus on programming. Programming really belongs to today’s digital literacy.

Q9: Where do you see Satelligence 3 years from now? What do you think is going to be your biggest challenge in the year(s) to come – raising capital, growing your team, finding more clients?

A: That’s a difficult question. The market as a whole is still growing so it’s difficult to say or know if or when you have reached relevance (ie +15% market share). We are very close to, if not already at product market fit. We see clients dripping in, our services are ready to be deployed on a global scale so there is nothing that would prevent exponential growth starting at the end next year. In that case I guess we’d grow to an organisation of between 50 – 100 people (including overseas offices).

Q10: You are based in Utrecht, Netherlands, how’s the startup scene? Are there many investors specifically looking at geospatial companies? Are there any local meetups/events that cater to the geo community?

A: In Utrecht there are some startups but not so much in the geo community. Most geo meetups are in Amsterdam (which is 30 min by train). There’s guys mapping heat islands with Landsat data and AI. There’s a drone company providing precision farming advice. And there are some freelance consultants providing geo advice and programming skills. There are some investors but not specifically targeted at geospatial companies. We do see a lot of AI / ML related startups lately applying AI to satellite / drone images. They are mainly coming from the technical universities though. Not so much from Utrecht.

Q11: Okay, this is a tricky one – on a scale of 1 to 10 (10 being the highest), how geoawesome do you feel today?

A: I would give myself a 6.5. I am generally happy with life and really not much is going on that would justify an overly negative or positive mark. Apart from that I see plenty of areas where I could improve, also geoawesome-wise. That would be the space between 6.5 and 10. So interpret my mark as: my life is happy and stable while I am excited about all the stuff that’s coming.

Q12: Any closing remarks for anyone looking to start their own geo startup?

A: Don’t do it. Join a startup. It’s the same as in sailing, it’s better to have a friend with a sailing boat than to own a sailing boat.

If anyone would like to reach you, what would be the best way to do so?

You can reach me best by email: vrielink@satelligence.com

The Next Geo is supported by Geovation:

Location is everywhere, and our mission is to expand its use in the UK’s innovation community. So we’re here to help you along your journey to success. Get on board and let’s start with your idea…

Location is everywhere, and our mission is to expand its use in the UK’s innovation community. So we’re here to help you along your journey to success. Get on board and let’s start with your idea…

Learn more about Geovation and how they can help turn your idea into reality at geovation.uk

About The Next Geo

The Next Geo is all about discovering the people and companies that are changing the geospatial industry – unearthing their stories, discovering their products, understanding their business models and celebrating their success! You can read more about the series and the vision behind it here.

We know it takes a village, and so we are thrilled to have your feedback, suggestions, and any leads you think should be featured on The Next Geo! Share with us, and we’ll share it with the world! You can reach us at muthu@geoawesomeness.com or via social media 🙂