Another day, another SPAC: Rocket Lab going public to build bigger rocket

As the SPAC frenzy among satellite companies continues, Rocket Lab has become the latest geospatial startup to announce its plans to go public by merging with a special purpose acquisition company (SPAC), Vector Acquisition Corporation.

The deal, which would give Rocket Lab an enterprise value of $4.1 billion, is expected to infuse the California-based space launch specialist with $750 million in cash when it closes in the second quarter of 2021. When that happens, Vector will change its name to Rocket Lab USA and the combined company will trade under the Nasdaq ticker symbol RKLB.

Courtesy: Rocket Lab

“This milestone accelerates Rocket Lab’s ability to unlock the full potential of space through our launch and spacecraft platforms and catalyzes our ambition to create a new multi-billion-dollar business vertical in space applications,” says Peter Beck, CEO and Founder of Rocket Lab.

Propelling this ambition is Neutron — a bigger, more advanced space launch vehicle that Rocket Lab plans to build after launching close to 100 small satellites with Electron. And this development will put Beck in much closer competition with Elon Musk’s SpaceX. Hopefully, the two companies can continue to coexist peacefully, even though Musk has hinted in a recent tweet that Neutron looks a little too familiar to SpaceX rocket Falcon 9:

Looks familiar haha. Nonetheless, the right move. Congrats to Rocket Lab.

— Elon Musk (@elonmusk) March 1, 2021

Neutron is designed as a reusable launch vehicle with an 8-ton payload lift capacity. As such, Neutron is apt for anything from mega constellation launches and deep space missions to human spaceflight. The rocket’s debut flight is slated for 2024.

“In the history of spaceflight, Rocket Lab is one of only two private companies that has delivered regular and reliable access to orbit,” Beck points out. “Not only are we the leader in small launch, we are the second most frequently launched rocket in the US annually and the fourth most frequent launcher globally.”

Alex Slusky, CEO of Vector, acknowledges that Rocket Lab is democratizing access to space by delivering end-to-end solutions across the launch and space systems markets. “Peter is a true visionary who has built a world-class company with discipline and grit. Rocket Lab is ideally positioned to continue to capture market share in the rapidly expanding space launch, systems, and applications markets.”

Satellite companies take the SPAC route

With today’s announcement, Rocket Lab has become a part of a growing league of satellite companies that have jumped aboard the SPAC bandwagon to raise funds.

Just last month, satellite imagery specialist BlackSky had announced a SPAC merger deal to raise $450 million in cash. Before that, in December 2020, rocket maker Astra merged with SPAC company Holicity in a deal that valued the rocket company at $2.1 billion. The same month, satellite-to-smartphone broadband company AST also entered into a SPAC deal with New Providence to give the former an equity value of $1.8 billion.

And in October 2020, space transportation specialist Momentus joined forces with Stable Road Capital in a SPAC blank-cheque merger to raise capital to grow a last-mile delivery network in space. Interestingly, Sir Richard Branson’s space tourism company Virgin Galactic also went public through a SPAC deal in 2019.

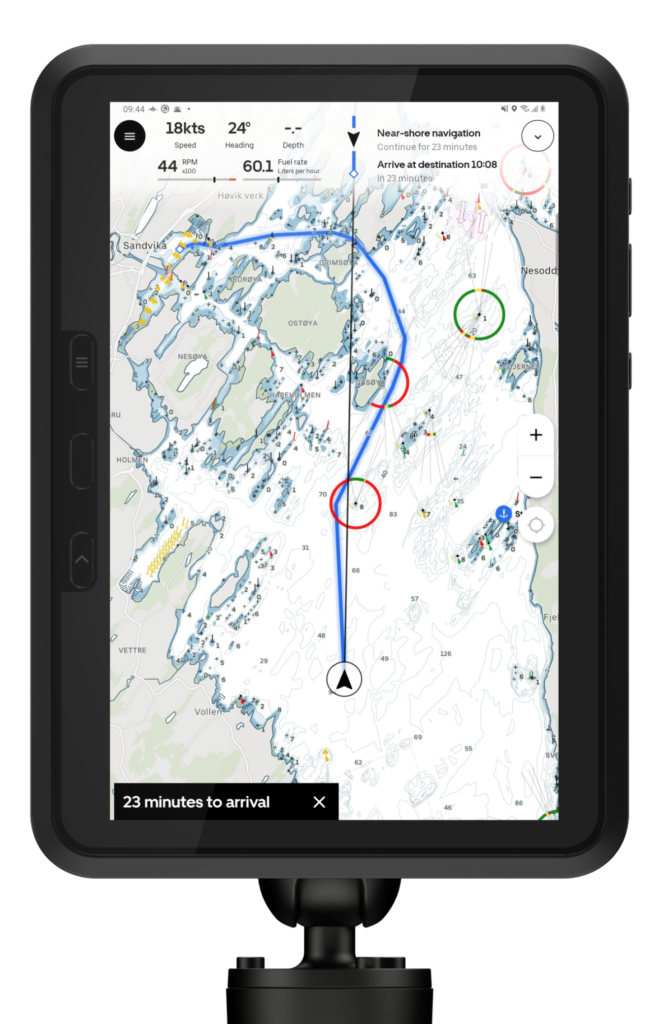

This week, Orca’s marine navigation product, the Orca Display Kit, opened up for pre-orders. The fully-integrated portable system consists of a 10.1-inch full-HD display tablet, a charging mount, and the Orca Core –the primary, 4G cellular-enabled navigation unit that integrates with a boat via NMEA 2000, and can fully replace the traditional NMEA 2000 GPS and compass units aboard.

This week, Orca’s marine navigation product, the Orca Display Kit, opened up for pre-orders. The fully-integrated portable system consists of a 10.1-inch full-HD display tablet, a charging mount, and the Orca Core –the primary, 4G cellular-enabled navigation unit that integrates with a boat via NMEA 2000, and can fully replace the traditional NMEA 2000 GPS and compass units aboard.