At industry conferences and in corporate sustainability circles, a hopeful refrain has emerged: that new ESG reporting requirements will spark a boom in the use of satellite Earth observation data. Mandates like the European Union’s new Corporate Sustainability Reporting Directive (CSRD) demand more detailed, verifiable information on companies’ environmental impacts, leading many to predict a surge in demand for the unique insights Earth observation (EO) can provide. But will these regulatory pressures truly drive enterprises to embrace EO data at scale, or will most companies opt for minimal compliance using familiar methods? This article explores that question by examining the intersection of ESG reporting and EO technology – the promise, the skepticism, and the emerging trends that could shape corporate uptake of satellite data.

For years, satellite imagery and remote-sensing data have been mainstays for governments and scientists monitoring the planet, yet corporate adoption for ESG purposes has lagged behind. Outside of notable early use cases in sectors like agriculture and utilities, the broader business world has been slow to integrate satellite data into decision-making. Sustainability reporting has traditionally relied on internal data collection and third-party assessments, often compiled into static reports or spreadsheets, with little geospatial context. Now, however, the convergence of advancing EO analytics and stricter sustainability disclosure rules is creating new momentum to bring “space data” into the boardroom.

New ESG Reporting Mandates: A Catalyst for Satellite Data

In recent years, governments have introduced sweeping sustainability disclosure regulations, raising the bar for corporate ESG data. For example, the EU’s CSRD took effect in 2023, expanding sustainability reporting to nearly 50,000 organizations (including thousands of non-EU companies) and requiring “granular and comprehensive” ESG metrics under a rigorous double materiality process. Companies must now report detailed environmental impacts – such as climate-related risks and greenhouse gas emissions – alongside their financial results. Crucially, these mandates extend into supply chains: the new EU Deforestation Regulation (EUDR) compels companies to gather geolocation coordinates for commodity suppliers and prove their products are deforestation-free. In other words, regulators are moving beyond self-reported assurances to demand verifiable, location-specific evidence of sustainability performance. Satellite monitoring is uniquely suited to meet this need, and many anticipate a “huge demand for satellite data for supply chain tracking,” with numerous firms joining startups like SourceMap or Satelligence to help companies monitor sourcing regions. In the broader ESG realm, public companies are also being pushed to publish climate risk analyses (e.g. under frameworks like TCFD), and corporations are “slowly waking up to the idea that Earth observation and geospatial data can be key tools in the process.”

Other jurisdictions are following suit. In the U.S., the Securities and Exchange Commission has floated climate disclosure rules, and states like California have passed laws mandating emissions and climate-risk reporting for large companies. Global initiatives (ISSB standards, TNFD for nature, etc.) likewise emphasize more quantitative, data-driven disclosure. This trend toward mandatory transparency creates a powerful incentive for companies to seek out robust data sources – and EO is poised to be one of them. A supply chain due diligence law might, for instance, require a palm oil importer to prove no illegal forest-clearing occurred at its plantations; a task nearly impossible without satellite imagery. As one geo-analytics expert noted, these new regulations are making sustainability data collection a must, not a maybe, which is “finally starting to have an impact” on demand for satellite solutions.

What Earth Observation Brings to ESG Reporting

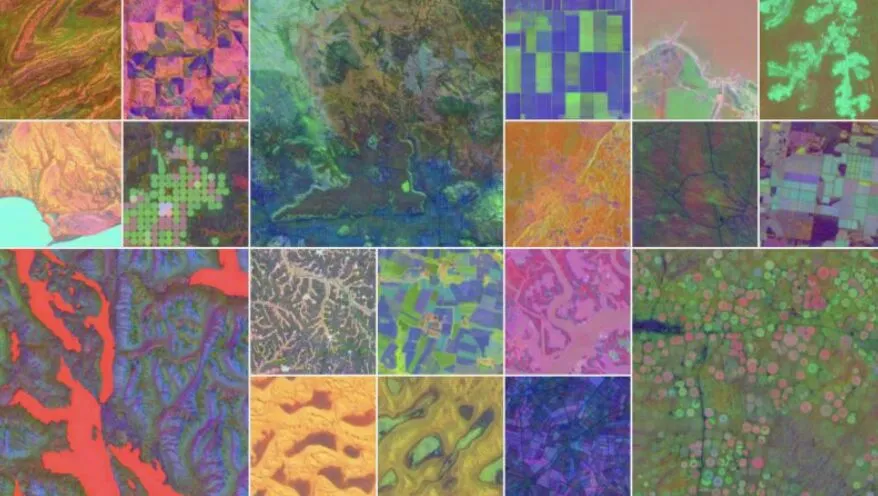

Earth observation data – encompassing satellite images, aerial sensors, and other geospatial information – offers something relatively new to corporate ESG reporting: independently verifiable, globally consistent measurements of environmental and social indicators. Properly used, EO data can augment or replace estimates that were previously based on sparse ground surveys or corporate self-reporting. It essentially provides a pair of unbiased eyes on the Earth, allowing companies and their stakeholders to observe changes in real time and across locations that would otherwise be hard to monitor. EO data has roles across all three pillars of ESG:

- Environmental: Satellites can directly measure or estimate key environmental KPIs – for example, tracking greenhouse gas emissions, detecting deforestation and land-use changes, or monitoring water usage and pollution. These capabilities enable companies to quantify their impacts (or those of their suppliers) on climate, forests, water resources and more with a level of coverage and objectivity not possible through traditional audits.

- Social: EO can support social impact assessments by observing environmental conditions that affect communities – for instance, monitoring the air quality or water quality in areas surrounding industrial sites to detect pollution that might harm local populations. In addition, satellites have been used to shed light on human rights issues, such as spotting illegal mining or identifying forced labor in remote locations (indirectly, via environmental proxies like illegal deforestation or nighttime light usage). These applications are still emerging, but they hint at how spatial data can inform the “S” in ESG.

- Governance: In terms of compliance and accountability, satellite data can be a powerful tool for corporate governance. Remotely sensed data can independently verify whether a company is adhering to environmental regulations and its own sustainability pledges – for example, by monitoring protected areas to ensure no encroachment or checking that a factory’s pollution levels remain within permitted limits. EO thus adds a layer of transparency to corporate reporting, making it harder to hide unsustainable practices.

The appeal of such objective data is growing. A recent global investor survey found 94% of investors are skeptical about the validity of companies’ sustainability reports, often due to unsupported or cherry-picked claims. Incorporating satellite-derived evidence can help bridge this credibility gap by providing measurable, third-party verification of ESG outcomes. For example, instead of simply trusting a supplier’s claim that “no forests were cleared” for a batch of cocoa, a company (or an auditor) can consult satellite-based deforestation alerts for that region to confirm it. In an era of heightened concern about greenwashing, EO data offers a way to “trust, but verify” what companies report.

At the same time, Earth observation is not a silver bullet. Turning raw imagery into actionable ESG insights requires analytics, expertise, and context. However, continuous improvements in data processing (often powered by AI) are making it easier to extract indicators like forest loss, land-use change, or methane concentrations from vast imagery archives. Many of these data (such as imagery from the EU’s Copernicus satellites or NASA’s programs) are openly available, meaning companies can tap into them at low cost – or rely on service providers who do so – to get global coverage on issues from carbon stocks to biodiversity. In some cases, EO data is actually the most cost-effective solution: for instance, monitoring deforestation across thousands of square kilometers via free satellite images and algorithms is far cheaper (and more accurate) than trying to deploy thousands of on-the-ground inspectors. This combination of accuracy, scale, and falling cost makes the promise of EO increasingly attractive as ESG reporting enters a new, data-centric era.

Reality Check: Are Companies Ready to Embrace EO Data?

If the potential is so great, one might ask why EO data isn’t already a staple in every sustainability report. The reality is that many companies approach ESG reporting as a compliance exercise or a PR initiative, rather than an opportunity for deep data integration. For all the talk of innovation, the typical enterprise may still favor the path of least resistance – doing what’s necessary to meet requirements, but no more.

There are some trailblazers. Nestlé, for instance, has for years used satellite services to police its supply chain’s environmental impact. The company adopted Airbus and Earthworm’s Starling satellite monitoring system back in 2016 to track deforestation in its palm oil, pulp, and cocoa sources, aiming to ensure they remain deforestation-free. Nestlé is now even piloting the use of next-generation high-resolution satellites (Airbus’s Pléiades Neo) to monitor the growth of trees it plants in reforestation projects – a level of rigor well beyond basic compliance. This shows what is possible when a corporation commits to leveraging EO for sustainability. However, such examples are still the exception, not the rule.

ESG veteran Judy Sandford observes that sustainability reporting in many firms “started out as a PR exercise” – essentially a way to burnish the brand’s image – and even today, with regulations looming, a lot of reporting remains checkbox-driven. Internally, it brought departments together to identify risks and opportunities, she notes, but now it’s fallen to the legal and compliance people because of all the incoming regulation – and they’re not as interested in telling nice stories. They just want to show they’re doing what they’re supposed to. In other words, many companies treat ESG reports as a duty to be fulfilled rather than a strategic tool. Sandford points out that since reporting became mandatory, companies often hand it to compliance teams who “just want to show they’re doing what they’re supposed to, making progress and being profitable.”

This compliance-oriented mindset can be a barrier to adopting new, rigorous data sources like EO. Implementing satellite monitoring or advanced analytics typically incurs additional cost and complexity – something companies will accept only if they see clear value or necessity. Outside of novel leadership cases (like Nestlé, or others such as some energy firms using satellites to detect methane leaks), the business case for EO data has to overcome the classic corporate priorities: cost control and risk aversion. It’s telling that in some quarters there has been political pushback, with claims that “all this ESG stuff” doesn’t help the bottom line. Profit remains king, and unless EO data can be shown to protect or increase that profit (by avoiding fines, winning investor favor, or identifying efficiencies), many firms will hesitate to invest in higher-accuracy but higher-cost data streams.

Indeed, analysts note a split in corporate behavior under the new ESG regime. Some companies are opting for bare minimum compliance – doing just enough to meet the letter of the law and limit legal exposure – especially in jurisdictions or industries where sustainability is viewed skeptically. Others, by contrast, are voluntarily aligning with the strictest global standards (even if not mandated) to bolster their credibility with investors and future-proof their operations. This divergence suggests that without additional pressure or incentives, many firms will stick to the former approach. If a cheap, traditional method (e.g. an annual supplier questionnaire or a one-time audit) can tick the compliance box, they might choose that over continuous satellite monitoring that offers more accuracy but at higher cost. Only if regulators or stakeholders demand evidence of outcomes – not just policies – will the majority be compelled to fully embrace EO data. In the EU deforestation context, for example, geolocation of farms is now required by law, forcing companies to gather coordinates and likely use satellite maps; but if the law didn’t require it, many might have been content with paper certificates from suppliers. In short, the ESG reporting revolution may boost EO adoption, but primarily among those companies (or those ESG metrics) where the value of better data clearly outweighs the cost.

On a positive note, investors and civil society may become the wildcard that pushes companies further. With nearly all investors expressing skepticism toward unverified ESG claims, companies have a growing reputational incentive to use more transparent data sources. A company that can say, “Here’s the satellite evidence of our progress” might earn more trust than one that says “just take our word for it.” Moreover, if EO data can help avoid scandals – for instance, catching a supplier’s forest clearing before an NGO exposes it – it can save a company from public relations disasters. These factors could gradually pull more enterprises into the EO orbit, even if regulations alone do not immediately do so.

From Images to Insights: Lowering Barriers to Adoption

One development that could accelerate corporate uptake of EO data is the evolution of the Earth observation industry itself. Recognizing that most companies don’t have in-house remote sensing teams, many EO providers are shifting their business models to make adoption easier. The buzzword is “Insights as a Service.” Rather than simply selling raw satellite images and leaving clients to figure out the rest, EO companies are increasingly delivering ready-made insights – analysis results, alerts, and indicators – as a subscription or on-demand service. The Earth observation data industry, notes one long-time analyst, has been “moving towards insights as a service” in which providers handle everything from data collection and processing to analytics, and serve up answers to the customer’s specific questions.

In practice, this means an ESG manager doesn’t need to be a geospatial expert to leverage satellite data. The provider might offer a dashboard or API that simply reports, say, the number of hectares of deforestation in the past month in the company’s sourcing areas, or an automated risk score for each facility based on satellite-observed flood risk. Behind the scenes, the vendor handles the complex imagery processing. As one commentator explains, this approach filters out complexity and offers “insights from satellite data (raw numbers downloadable as tables)” – sparing customers from having to interpret pixels or spectra themselves. Companies such as Privateer (prevously known as Orbital Insight), Descartes Labs (acquired by Earth Daily) , SpaceKnow, and Ursa Space Systems have pioneered this model, extracting data from satellites (often combining it with other sources like weather or financial data) to answer business questions about supply chain activity, environmental change, economic trends, and more. Even satellite operators like BlackSky, Planet, and Maxar have built their services around delivering analytic alerts (for example, detecting the number of ships in a port or the expansion of a mine) rather than just selling imagery – a testament to the shift toward end-user relevance.

The result is a more SaaS-like experience for companies: EO insights are delivered as a feed or report that integrates into their workflows, and the end-users don’t need to know technical details like spatial resolution or sensor types to benefit. This dramatically lowers the barrier for adoption, since companies can get value from satellite data with minimal effort or training, much like they subscribe to any cloud software solution.

Likewise, a new crop of niche solution providers is offering “ESG analytics as a service” tailored to specific reporting needs. For example, several startups and NGOs now specialize in deforestation monitoring for supply chain due diligence – using satellite imagery (optical and radar) to provide brands with automated alerts and annual forest loss reports for their sourcing regions. Rather than a company manually poring over maps, the service might send an alert: “Alert – 5 hectares deforested this week near Farm XYZ in your cocoa supply chain.” This helps companies catch and address issues proactively to remain compliant with regulations like EUDR. Other providers focus on carbon accounting and climate risk, offering, say, satellite-based emissions tracking (to verify carbon footprint data) or physical climate hazard maps that can feed into a firm’s risk disclosures. The key is that the end-user receives a packaged insight aligned to an ESG metric they care about, not a file full of unprocessed images.

We’re already seeing the industry market these solutions directly for compliance. Geospatial vendors are advertising capabilities to, for instance, “monitor land use and deforestation with high-resolution imagery, track sourcing locations to meet EUDR due diligence requirements, and assess sustainability metrics for ESG reporting under CSRD guidelines.” In other words, the EO sector is actively positioning itself as an enabler of automated ESG reporting, translating raw data from space into the language of sustainability frameworks. This trend is not only convenient for companies – it’s essential. If Earth observation is to truly go mainstream in ESG reporting, it must speak to executives in terms of solutions and outcomes (e.g. “compliance achieved” or “risk mitigated”), not terabytes of imagery. The good news is that this is happening. As data standards improve and APIs make integration seamless, we can expect EO-driven indicators to start popping up in sustainability software dashboards and annual reports, often without the end-user even realizing the complex technology behind them.

Conclusion

In conclusion, ESG reporting mandates like CSRD are poised to nudge more companies toward using Earth observation data – but that push will likely be met with both enthusiasm and inertia. On the one hand, satellites provide an unmatched ability to measure what was previously immeasurable in corporate value chains, offering transparency that can enhance accountability and trust. On the other hand, many firms will treat new reporting rules as simply another compliance checkbox, opting for the easiest path to satisfy regulators rather than pursuing the most accurate data. The actual outcome will depend on factors like enforcement rigor, stakeholder pressure, and the continued lowering of costs and complexity for EO solutions.

There is cause for optimism: as the quality of ESG data becomes a differentiator for investors and customers, businesses may find strategic advantage in leveraging the best available information. The geospatial industry’s shift to delivering insights (not just imagery) lowers the entry barrier significantly, making it more feasible for non-technical organizations to incorporate satellite analytics into their sustainability workflows. If early adopters can demonstrate value – for instance, by avoiding supply chain scandals or identifying efficiency opportunities – it could catalyze broader uptake across industries.

Ultimately, ESG regulations seem likely to accelerate corporate adoption of EO data, but perhaps in a gradual, sector-by-sector manner rather than an overnight revolution. Deforestation monitoring and climate risk assessment are two areas already showing momentum, and success stories there may spur use of EO for other ESG indicators. Given the enormous potential quantified by researchers – Earth observation insights are projected to generate over $700 billion in economic value and help abate 2 gigatons of CO₂ annually by 2030 – even a modest boost in adoption driven by ESG compliance could yield significant benefits for both business and the planet. Realizing that promise, however, will require concerted effort to ensure ESG reporting doesn’t devolve into a superficial exercise, but instead becomes a genuine catalyst for better data and better decisions. In that journey, Earth observation can play a pivotal role, provided enterprises are willing to look up to the satellites – and down to Earth – for the insights that truly matter.

Did you like the article? Read more and subscribe to our monthly newsletter!