Geospatial at the Core of Germany’s Financial Sector: A Look at the Key Players

When I started my master’s in Geodesy and Geoinformatics at the Technical University of Munich, I didn’t expect my first internship to completely change how I thought about geospatial data. At Munich Re, one of the world’s leading reinsurance companies, I was introduced to the world of insurance and risk modeling, something I had never experienced before. Learning how satellite imagery and geospatial intelligence could be used to assess natural disasters, calculate financial risks, and even design new types of insurance products was eye-opening. It was my first real glimpse into how Earth observation data could directly shape the financial industry, and honestly, it blew my mind.

That experience also made me realize how central Germany is to this shift. The country has over 500 insurance companies and 1,400 credit institutions, together forming one of Europe’s largest financial markets. Insurance premiums alone amount to about €226 billion, while private households hold nearly €7.7 trillion in financial assets. Add to that the presence of global reinsurers like Munich Re and Hannover Re, major banks such as Deutsche Bank and Commerzbank, and a vibrant ecosystem of fintechs and proptechs, and Germany stands out as one of the most exciting places to study how geospatial technologies are transforming finance.

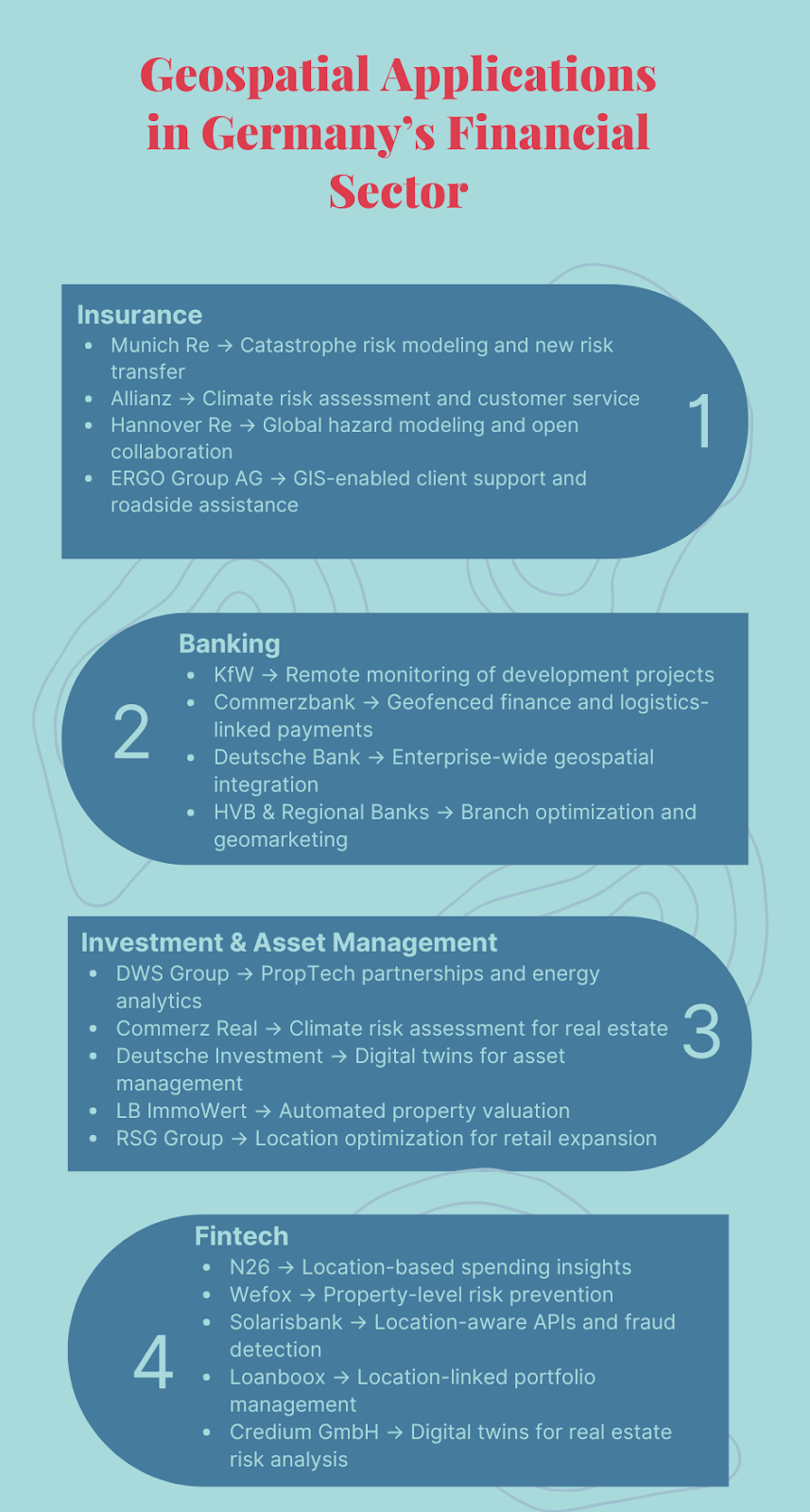

In this article, I’ll walk through how different parts of Germany’s financial sector are using geospatial data. We’ll start with the insurance industry, which has always been built on risk assessment, and look at how companies like Munich Re, Allianz, and others are leading the way. Then we’ll move into banking, investment management, and finally the fintech sector, to see how location intelligence is driving everything from fraud prevention to ESG-focused investing. My goal is to show why geospatial is no longer just about maps. It is becoming a core driver of financial decision-making in Germany.

To set the stage, the infographic below summarizes the main companies and how they apply geospatial technology. The sections that follow provide a closer look at each case.

1. Insurance Giants: Leaders in Geospatial Innovation

The insurance industry, a sector fundamentally built on risk assessment, is leveraging geospatial technology to a new degree. Location intelligence is reshaping how these companies operate, from catastrophe modeling to underwriting and customer engagement.

1.1 Munich Re: Transforming Catastrophe Modeling

Munich Re has long been a global leader in catastrophe risk assessment and modeling. Its NatCatSERVICE database, which is constantly updated with new event data, is one of the most comprehensive repositories of natural disaster information in the world. The database documents thousands of events from floods in Europe to hurricanes and earthquakes in North America, providing insurers, governments, and researchers with historical data on losses and exposure. This foundation of geospatial-driven data underpins Munich Re’s core risk management and underwriting capabilities, helping the company determine risk premiums, allocate capital efficiently, and design insurance products tailored to specific geographies.

In 2024, Munich Re reported a net profit of €5.67 billion and insurance revenue of €60.83 billion. Beyond historical catastrophe data, Munich Re is pioneering innovations in new areas of risk transfer. One notable example is its aiSure product, which provides insurance coverage for financial losses and legal liabilities arising from errors in artificial intelligence models.

1.2 Allianz: Bridging Risk Management and Customer Engagement

Allianz has incorporated geospatial intelligence in multiple ways, ranging from strategic risk analysis to operational customer service. Its Climate Adaptation & Resilience Services (CAReS), a strategic B2B platform, allows commercial clients to evaluate long-term climate risks. CAReS integrates historical climate data, predictive models, and scenario analysis to help clients understand potential impacts of hazards such as floods, storms, or heat events over extended time horizons.

By providing forward-looking assessments, Allianz enables businesses to take preemptive measures and optimize risk management strategies. In addition to long-term climate risk assessment, Allianz has applied geospatial technology operationally. The company uses the Google Maps Platform to optimize dispatch and tracking for roadside assistance, allowing staff to reach clients efficiently and improve service delivery.

1.3 Hannover Re: Modeling Complex Risks Globally

Hannover Re uses geospatial technology to assess complex, multi-sector risks across global markets. Satellite imagery, hazard maps, and statistical modeling help the company evaluate potential exposure to natural disasters such as floods, earthquakes, and wildfires. This enables Hannover Re to design reinsurance solutions tailored to the unique needs of its clients while keeping overall portfolio exposure under control.

A distinguishing feature of Hannover Re’s strategy is its investment in open-source and collaborative initiatives. For example, its work with the Global Earthquake Model (GEM) demonstrates a commitment to transparent, globally accessible risk assessment tools.

1.4 ERGO Group AG: Enhancing Assistance Services with GIS Technology

ERGO Group AG has deployed geospatial technology to improve client support and operational efficiency, particularly through its collaboration with con terra GmbH on the ERGOGIS platform. This centralized web-based GIS system allows assistance staff to determine client locations accurately using address searches, motorway kilometrage, or points of interest (POI). An integrated route planner calculates optimal towing and service routes, improving the speed and efficiency of roadside assistance.

ERGOGIS also supports perimeter searches for configurable POI topics, including hotels, petrol stations, and restaurants. Built on Esri ArcGIS Server and Microsoft SQL Server, with Silverlight interfaces and Microsoft Bing Maps integration, the platform combines advanced geospatial technology with a user-friendly design.

1.5 Broader Implications for the Industry

The use of geospatial intelligence by these leading German insurers highlights a broader industry trend. Satellite imagery, GIS platforms, and predictive modeling are not only supporting traditional risk assessment but are increasingly integrated into customer-facing services and operational workflows. Smaller insurers and startups are also entering the space through partnerships with tech providers, creating a collaborative ecosystem that allows access to advanced analytics without heavy investment in infrastructure.

2. Banking Institutions: Leaders in Geospatial Innovation

The German banking sector has increasingly integrated geospatial technology into its operations, moving beyond simple mapping to strategic, data-driven applications. Banks are leveraging location intelligence to optimize risk management, operational efficiency, customer engagement, and new business models, demonstrating the growing importance of geospatial capabilities in financial services.

2.1 KfW: Remote Monitoring for Global Development Projects

KfW, Germany’s state-owned development bank with assets exceeding €600 billion, uses geospatial intelligence to monitor and verify global development projects, particularly in remote or politically sensitive regions. For instance, agricultural rehabilitation along the Niger River is tracked remotely to assess vegetation health and irrigation improvements. Beyond agriculture, KfW engages in a collaboration with WWF Germany to map forest carbon stocks using LiDAR and hyperspectral sensors. This allows KfW to ensure accountability, track environmental outcomes, and make data-driven decisions even in regions where on-the-ground monitoring would be costly or dangerous. The use of geospatial technology helps KfW prioritize interventions, allocate resources effectively, and report progress transparently to stakeholders, demonstrating how advanced mapping can support global development at scale.

2.2 Commerzbank AG: Linking Physical Events to Automated Finance

Commerzbank, serving roughly 9 million retail customers, integrates geospatial intelligence into both consumer-facing and operational applications. Its mobile app allows customers to quickly locate nearby ATMs and branches, enhancing customer convenience and engagement. On the operational side, the Internet-Based Automated Finance (IBAF) platform, developed with T-Systems and Fraunhofer IML, connects IoT sensor data and geofenced locations to financial transactions, automatically triggering payments when goods reach predefined locations. This innovation not only improves operational efficiency but also opens new possibilities for B2B financial models by linking physical supply chain events directly to financial processes. By leveraging geospatial data, Commerzbank reduces manual intervention, minimizes delays, and strengthens transparency in logistics-related finance.

2.3 Deutsche Bank AG: Building a Foundation for Future Geospatial Analytics

Deutsche Bank, with total assets of over €1.5 trillion, emphasizes building enterprise-wide geospatial capabilities rather than isolated applications. Its Private Bank Data Platform (PBDP) on Google Cloud consolidates client and partner data into a cloud-native environment with geospatial features. One current use case involves AI-powered Named Entity Recognition (NER) to extract locations from scanned documents for sanctions and embargo checks. This foundational approach enables Deutsche Bank to integrate geospatial intelligence across multiple functions, from risk management and compliance to potential future applications in market analysis and client advisory services.

2.4 Hypo Vereinsbank (HVB) and German Regional Banks: Optimizing Branch Networks and Market Insights

HVB and regional banks, including Raiffeisenbank Straubing and GLS Bank, focus on leveraging geospatial intelligence to improve branch performance, market insights, and customer engagement. They partner with WIGeoGIS to access geomarketing, branch network optimization, and demographic mapping tools. HVB uses these insights to simulate scenarios, evaluate branch efficiency, and guide strategic decisions, while regional banks apply geocoding and demographic analysis to assess market penetration and identify opportunities for sales growth. By outsourcing geospatial expertise, these banks can efficiently leverage advanced analytics without large upfront investments, allowing them to make data-driven decisions that strengthen local presence and customer service.

2.5 Broader Implications for the Banking Industry

The increasing adoption of geospatial technology across German banks signals a shift toward location intelligence as a core strategic capability. Institutions like KfW use it for monitoring global development projects, Commerzbank links physical events to automated financial transactions, Deutsche Bank builds enterprise-wide geospatial infrastructure, and HVB and regional banks optimize retail operations. Strategic partnerships with UP42, T-Systems, Google Cloud, and WIGeoGIS accelerate adoption and scalability. Across the sector, geospatial applications range from consumer-facing tools to mission-critical monitoring and entirely new business models, demonstrating the transformative potential of location intelligence in financial services.

3. Investment and Asset Management Institutions: Geospatial-Driven Decision Making

Leading German asset managers are increasingly using geospatial technology to enhance investment strategies, streamline operations, and integrate sustainability considerations. From PropTech partnerships to in-house digital twins, location intelligence is helping firms make faster, more data-driven decisions in real estate and infrastructure management.

3.1 DWS Group: PropTech Partnerships and Smart Building Analytics

DWS Group, one of Germany’s largest asset managers, combines strategic PropTech investments with internal geospatial initiatives to enhance real estate decision-making and sustainability outcomes. The firm has invested in Skyline AI, an Israeli PropTech company that leverages AI and geospatial datasets to analyze commercial real estate opportunities. This platform enables DWS to conduct faster, more comprehensive assessments of potential investments, supporting informed portfolio decisions. Internally, DWS applies smart building energy analytics across its properties, using location-based sensor data to optimize energy consumption and advance ESG objectives, demonstrating how geospatial intelligence can improve both operational efficiency and sustainability.

3.2 Commerz Real: Strategic PropTech Investments for Climate Risk Assessment

Commerz Real leverages geospatial technology through partnerships and targeted investments to assess climate-related risks and enhance portfolio resilience. As an anchor investor in the PropTech1 Ventures Fund, the company gains early access to innovative firms using geospatial data for real estate and infrastructure applications. Notably, platforms like Climate X allow Commerz Real to evaluate long-term physical risks, including flooding and extreme weather events, using climate and location models. By integrating these insights into due diligence and asset management, Commerz Real strengthens sustainability and resilience across its portfolio while making investment decisions grounded in detailed spatial risk analysis.

3.3 Deutsche Investment: Digital Twins for Efficient Asset Management

Deutsche Investment incorporates AI and geospatial data into its real estate strategy to support data-driven and sustainable property management. Partnering with the German PropTech firm Predium, the company generates digital twins of its properties using satellite imagery, 3D modeling, and AI analysis. These digital replicas allow simulations for renovations, capital allocation, and sustainability planning. Leveraging geospatial intelligence enables Deutsche Investment to make fast, evidence-based decisions that maintain profitability while complying with ESG regulations, highlighting the operational value of spatial analytics.

3.4 PROXIMUS Group: Geospatial-Assisted ESG Due Diligence

PROXIMUS Group applies geospatial technology to streamline ESG-focused due diligence during real estate acquisitions. Using Predium’s AI-powered platform and digital twin capabilities, the firm evaluates sustainability factors efficiently without relying on external consultants. This approach allows PROXIMUS to make timely, informed investment decisions while embedding decarbonization strategies into acquisitions, showing a direct operational benefit from geospatial data.

3.5 LB ImmoWert: Automated Location-Based Property Valuation

LB ImmoWert, a real estate valuation firm for institutional investors and banks, places geospatial intelligence at the core of its operations. Using Geospin’s Location Intelligence Assistant (LIA), which draws on over 800 location-based parameters, including demographics, infrastructure, and market data, the company performs automated property assessments and rental forecasts. This reduces time and cost compared to traditional appraisals, while providing objective, data-driven insights even in markets with limited information.

3.6 RSG Group: Geospatial Insights for Portfolio Expansion

The RSG Group, a global fitness and lifestyle company, applies geospatial intelligence to optimize real estate decisions for its brands, such as McFit. Using TargomoLOOP from German location intelligence provider Targomo, RSG combines internal and external data, including demographics, competition, and population movement, to create heatmaps of potential new locations. These insights guide data-driven expansion, allowing RSG to forecast market potential and make confident investment choices.

3.7 Broader Implications for the Investment and Asset Management Sector

The adoption of geospatial technology in Germany’s investment and asset management sector reflects a shift toward data-driven, sustainability-focused decision-making. Firms leverage AI, digital twins, and location intelligence to optimize operations, manage risk, and integrate ESG considerations into core strategies. Partnerships with PropTech firms and specialized geospatial providers accelerate innovation, enabling both small and large firms to analyze complex real estate and infrastructure portfolios efficiently. Across the sector, geospatial technology transforms traditional asset management into a highly analytical, forward-looking practice, where decisions are guided by precise location-based insights and scenario modeling.

4. Fintech Innovators: Location Intelligence at the Core of Digital Finance

Germany’s fintech sector has grown rapidly over the past decade, spanning neobanks, insurtech startups, and B2B platforms that are redefining financial services. Across the sector, geospatial data is increasingly central, enhancing security, enabling smarter risk assessment, and supporting innovative, location-aware financial products.

4.1 N26: User Features and Advanced Analytics

N26 allows users to tag transactions with location-based hashtags like #berlin, providing insights into spending patterns. This feature helps users track expenses by location, aiding in budgeting and financial planning. Additionally, users can add custom tags such as #portugal_trip to further categorize their spending. These tags enhance the Monthly Wrap-Up feature, which offers a snapshot of monthly spending, including top spending categories and retailers.

4.2 Wefox: Property-Level Risk Assessment

Wefox, a Berlin-based insurtech with over 3 million users, is developing a risk prevention product that leverages smartphone and connected device data to warn users of potential dangers, such as poor road conditions or leaving a window open during a storm. This proactive use of real-time geospatial information helps enhance safety, improve underwriting accuracy, and reduce potential losses, demonstrating the operational value of location intelligence.

4.3 Solarisbank: Enabling Location-Aware Services via APIs

Solarisbank, a Berlin-based Banking-as-a-Service provider supporting over 1,000 partners, offers a suite of APIs that enable location-aware services. While specific geofenced payment or location-based offer APIs are not explicitly detailed in the available documentation, their platform supports device monitoring and fraud detection through device fingerprinting. Partners can integrate these capabilities to enhance security and compliance within their applications (Solarisbank API documentation).

4.4 Loanboox: Linking Finance to Location

Loanboox is a B2B debt financing platform that leverages geospatial intelligence to enhance portfolio management and decision-making. By integrating financial datasets with interactive maps, the platform allows clients to gain a “360-degree portfolio overview”, providing a holistic view of all financial instruments, loans, credit lines, and guarantees tied to specific assets. This comprehensive visualization enables users to assess risks, conduct scenario analyses, and make informed, data-driven decisions based on precise location-linked insights. By tying financial data to geospatial information, Loanboox places location intelligence at the core of strategic finance, helping organizations optimize asset management, anticipate potential risks, and strengthen their overall financial strategy.

4.5 Credium GmbH: Digital Twins for Real Estate Risk Analysis

Credium GmbH, a German PropTech-insurtech firm, creates high-resolution digital twins of properties using 3D modeling, satellite imagery, and socio-economic data. These platforms enable banks, insurers, and investors to conduct precise risk assessments, sustainability analyses, and data-driven decision-making. By combining geospatial intelligence with AI analytics, Credium helps clients make faster, more accurate decisions in real estate, insurance, and investment planning.

4.6 Broader Implications for the Fintech Sector

The fintech industry in Germany demonstrates how geospatial technology can enhance both operational security and strategic decision-making. From neobanks using geolocation to fight fraud, to insurtechs assessing property-level risks, and proptechs creating digital twins, location intelligence is becoming a standard tool across financial innovation. By embedding geospatial data into APIs, digital platforms, and risk models, fintech firms are not only improving user experience and compliance but also laying the groundwork for entirely new forms of financial products and services.

Germany’s financial sector is no longer experimenting with geospatial data. It is laying the foundation for a profound transformation. Insurers, banks, asset managers, and fintechs have already shown how spatial intelligence can improve risk modeling, optimize operations, and strengthen sustainability efforts. The real question is how quickly these tools will move from isolated projects to becoming the standard across the industry.

The pressures of climate change, regulatory scrutiny, and digital disruption will only accelerate this shift. Institutions that embrace geospatial intelligence today will not just manage risk more effectively. They will uncover new opportunities, develop innovative products, and set benchmarks for resilience in Europe’s financial markets. Those who hesitate risk being left behind as the map of finance continues to evolve.

Adoption will not be without obstacles. Financial institutions need to recognize that Earth observation data, while powerful, has limitations that depend on factors such as spatial resolution, temporal frequency, and analytical methods. The challenge lies in integrating these datasets into financial models in a way that produces insights stakeholders can trust. Convincing decision-makers of the value of geospatial intelligence in high-stakes financial contexts is not always straightforward. Data privacy concerns, compatibility with legacy systems, and the demand for skilled professionals to interpret complex datasets add further layers of difficulty. These barriers should not slow progress, but they highlight the importance of transparency, rigorous validation, and collaboration between geospatial experts and financial leaders.

For professionals, innovators, and decision-makers, the task is clear: treat geospatial intelligence as a core business capability. The institutions that learn to understand where risks and opportunities emerge will be the ones shaping the next decade of finance. The map is no longer a background detail. It is an invitation to act.

Python package:

Python package: