Meeting Harvesting – the startup that is using Geospatial tech to bring finance to farmers #TheNextGeo

In a world with over 7 billion people, which is set to reach over 10 billion by the end of the century, it is easy to understand the stress and importance of one of our oldest industries – agriculture. Can we grow enough food in a sustainable fashion for the billions of people that call this planet their home? The answer is YES (read this article by Brookings or pretty much the first page when google “10 billion people“). If we can bring technology to farming at scale, improve financing and reduce food wastage, feeding 10 billion people is definitely not a problem. However, in most emerging markets where farmers still rely on livestock for tilting their farm, technology is the least of their problems, access to finance is. As GeoGeeks, we know we can use remote sensing and geospatial analysis to help farmers improve their yields but can we use the same technologies to finance them? Ruchit Garg, the founder & CEO of Harvesting believes so. Read on!

Q: Ruchit, let’s get straight into it. Harvesting inc uses remote sensing in a rather interesting way. Instead of the more “obvious” way of using remote sensing and geospatial analysis to tell farmers what crops to plant, you are using it to connect finance with farmers. Tell us more!

A: Yes indeed! We wanted to take the big data that we gather through geospatial analysis towards addressing one of the core challenges that agriculture sector or small farm holder farmers face across the world. Remember that in developing countries where there is a dire need to better productivity and therefore deployment of remote sensing technology could be imperative, the same is not possible unless you have funds to use and adopt a new and modern technology.

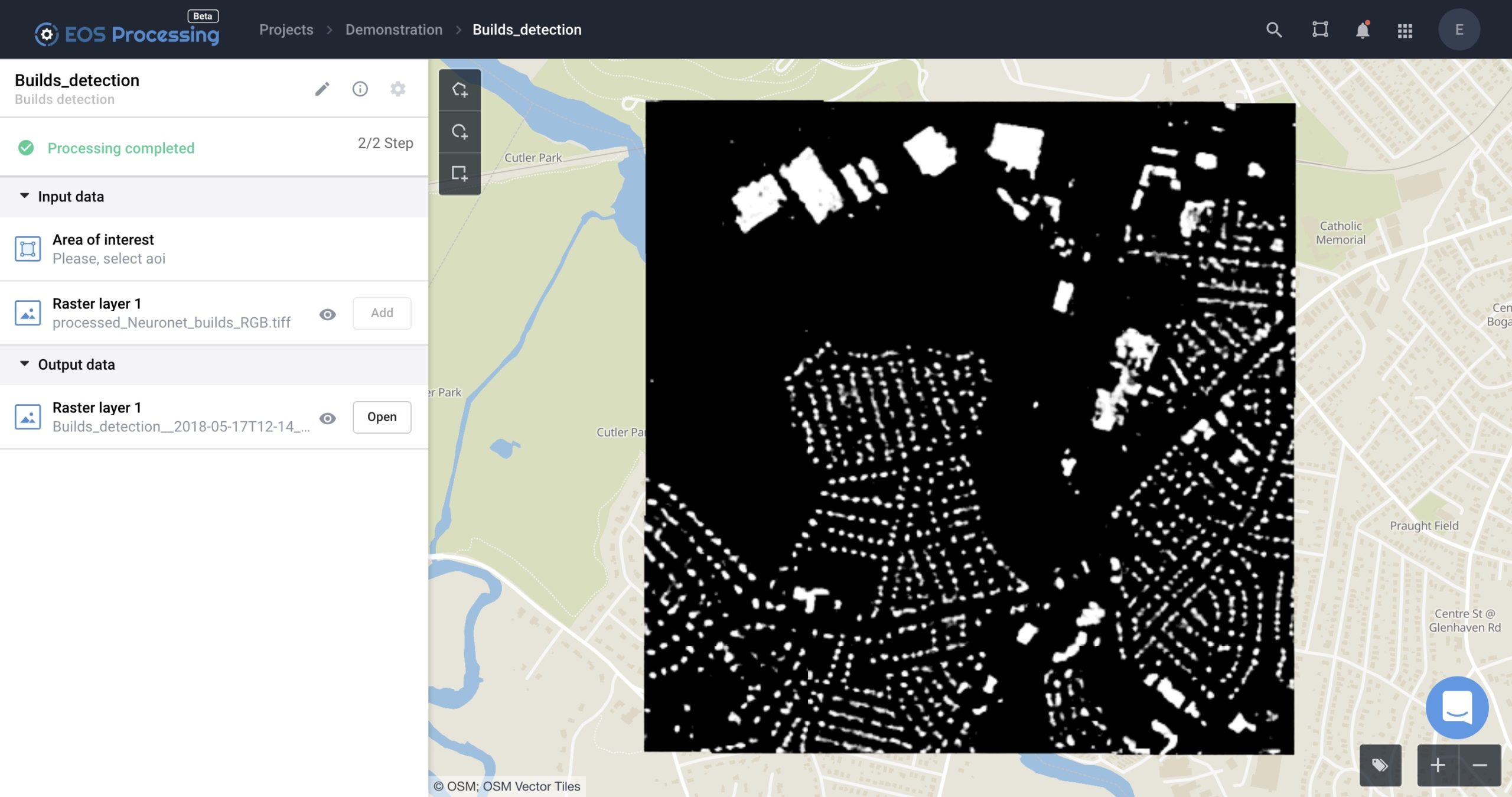

Therefore after spending extensive time understanding the dynamics of the agriculture sector, we were clear that we need to address the big elephant in the room – finance. And use technology to overcome this hurdle. As much as remote sensing and geospatial analysis help in farm management it also is able to give insights on the probability of farm produce far more accurately based on machine learning, variables, and historical data yields. It is this gap of not being able to assess creditworthiness and his seasonalities with regard to loan payments that have resulted in a lending deficit which we are working to bridge by assessing the small farms.

Q: A credit risk score for farmers based on remote sensing data sounds awesome! But then, how do you derive a credit risk score for a farm using remote sensing? I suppose the credit risk score depends on the local weather, type of crop, soil fertility and a lot of other variables. Could you perhaps elaborate a bit on how it works?

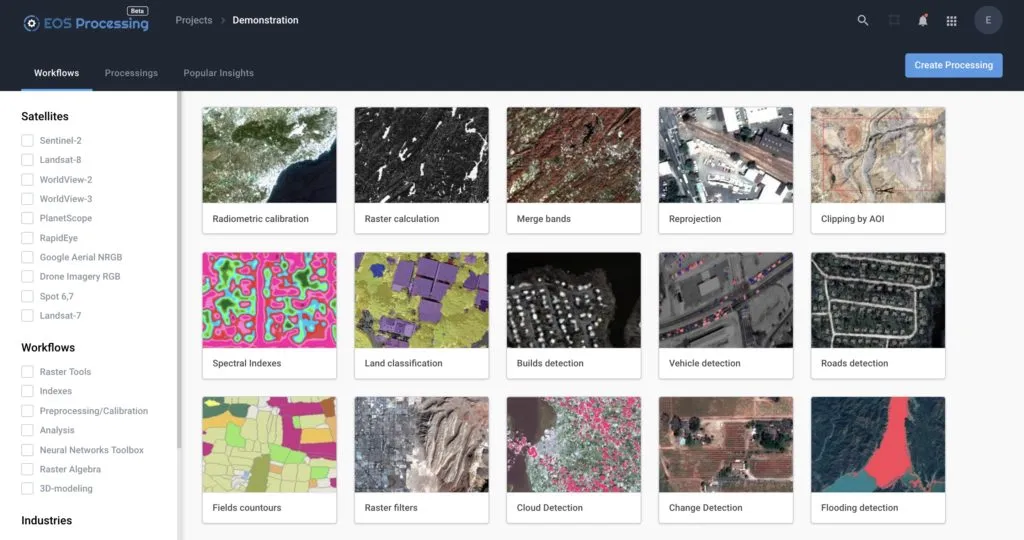

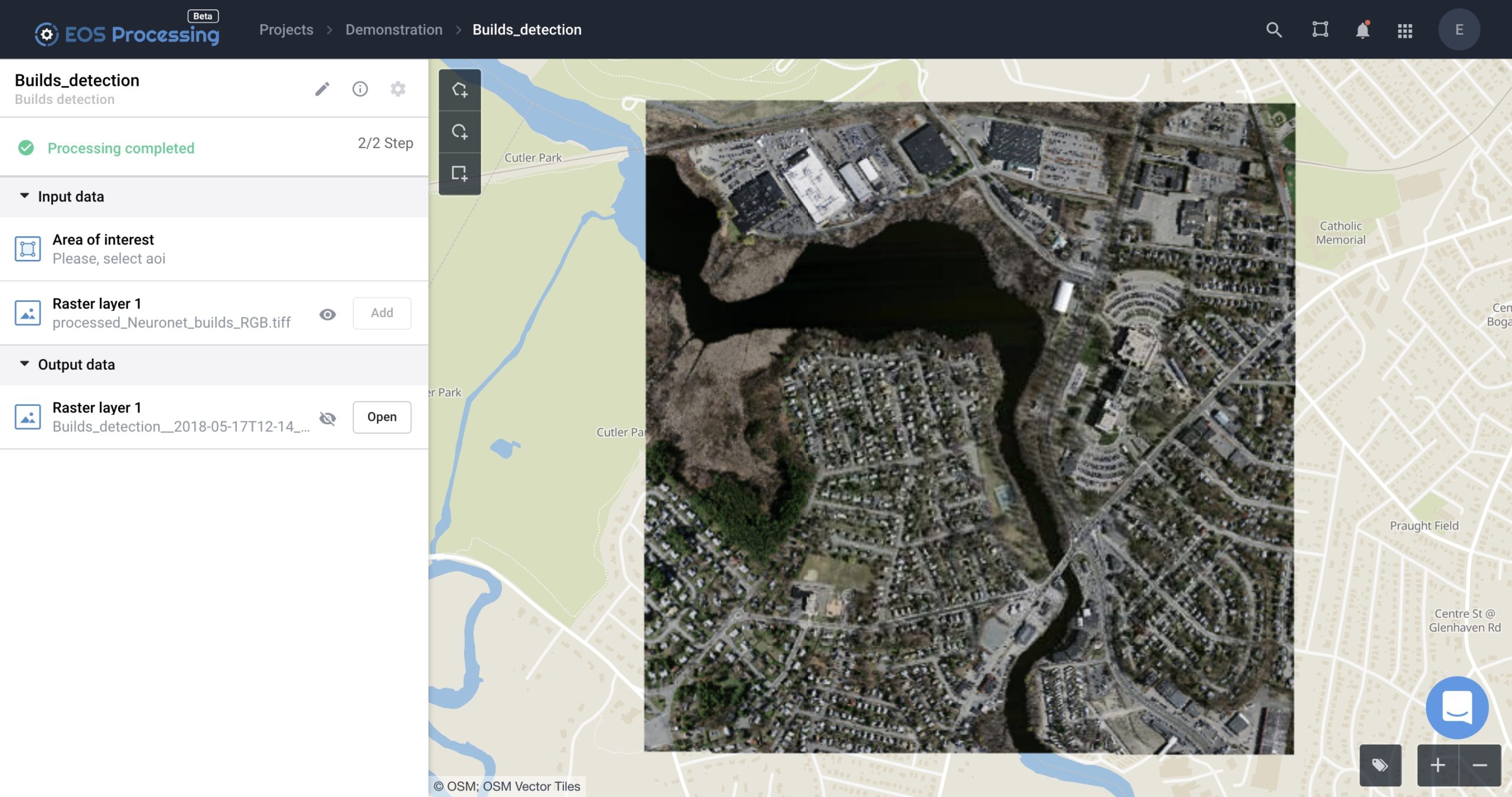

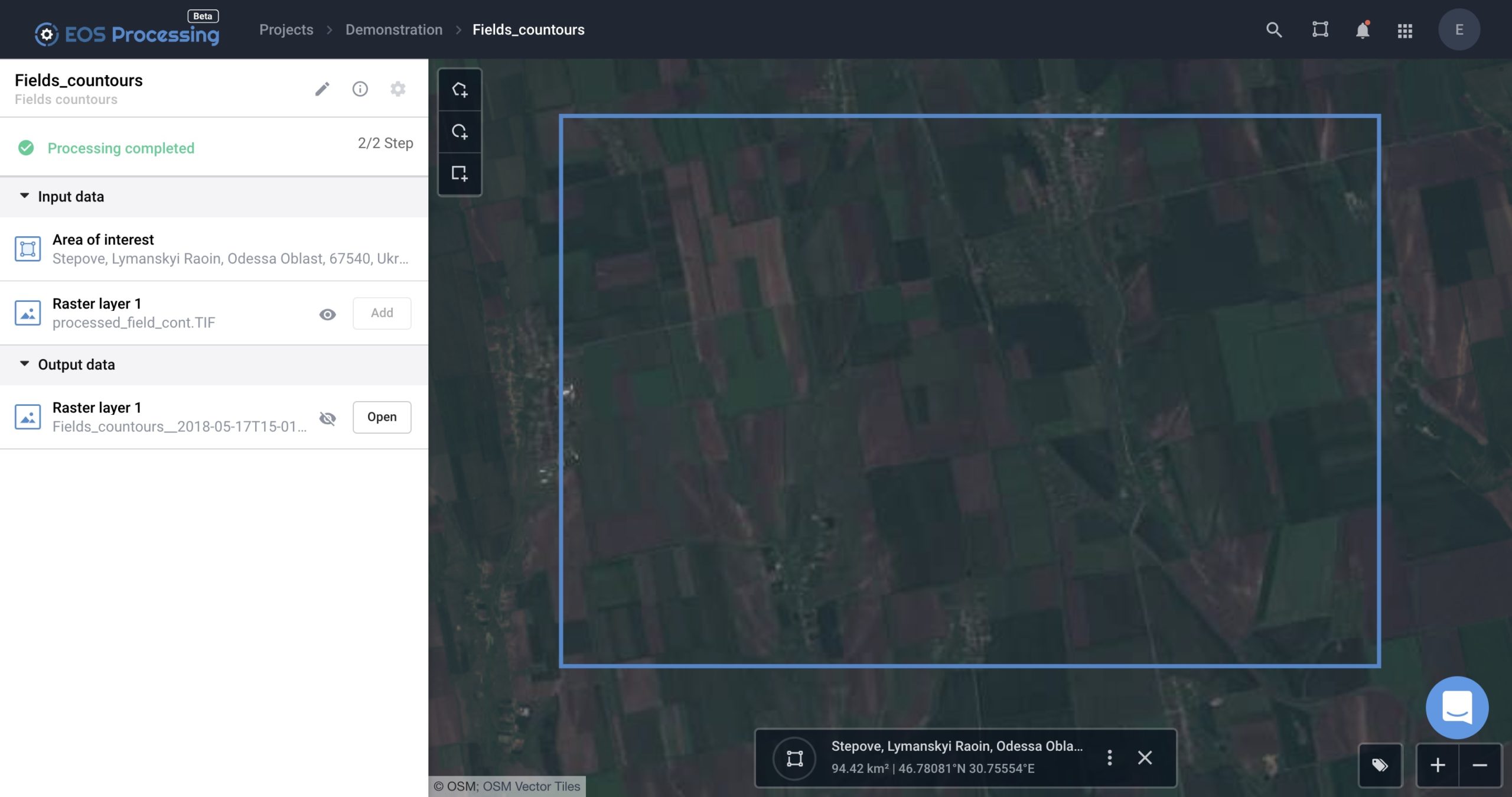

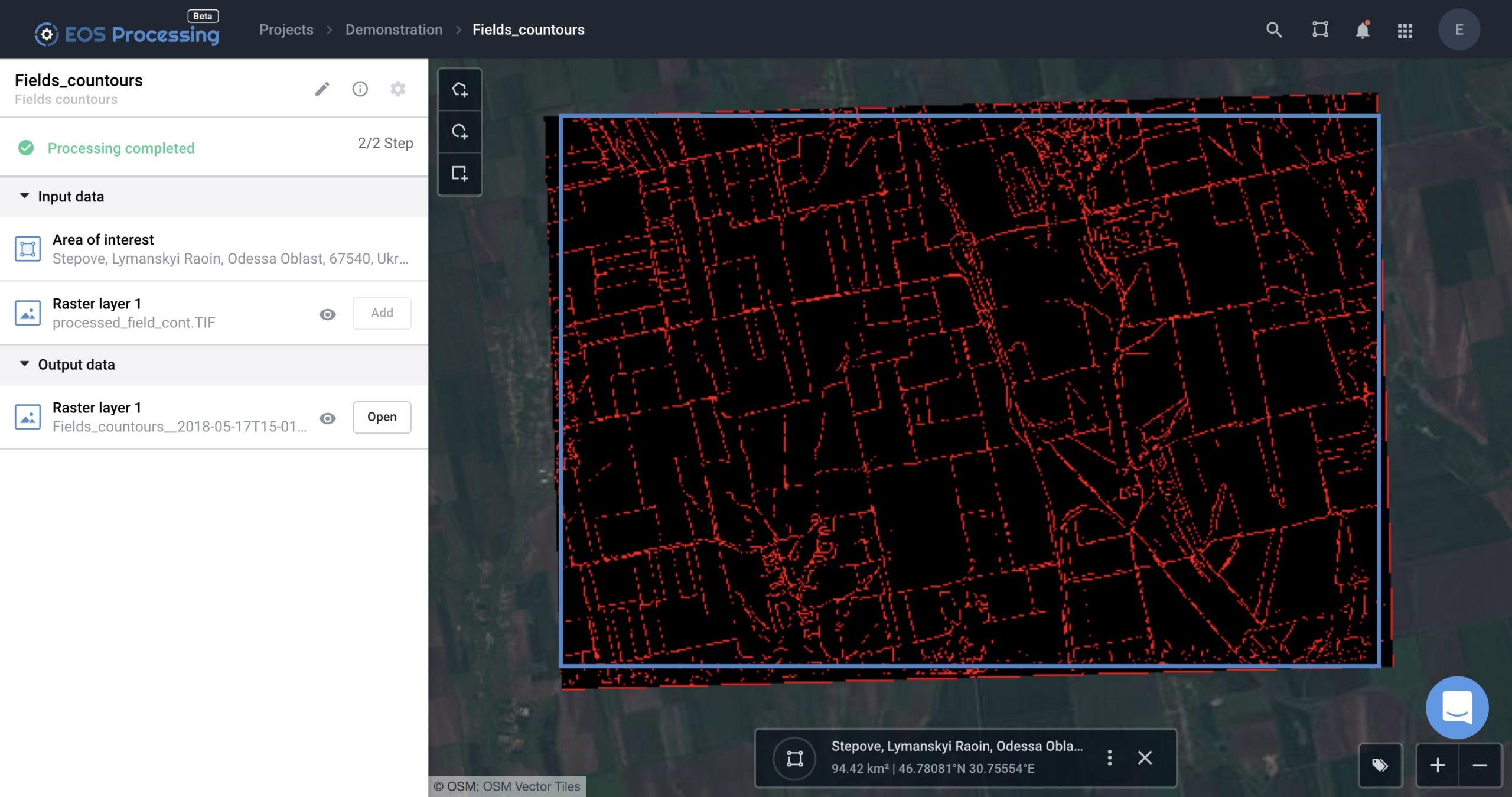

A: Absolutely, as you mentioned credit score depends on all those factors and more. The geo-spatial technology through Normalized Difference Vegetation Index (NDVI) and Normalized Difference Water Index (NDWI) can be used to monitor crop growth, health, and status throughout the cropping cycle and is also indicative of soil health. The resolution of publicly available data (Landsat data at 30m or Sentinel-2 data at 10m) is getting us closer to being able to model yields even on very small holdings of land. So taking these inputs including historical yields into consideration, and customizing variables as required by financial institutions into machine learning platform, we are able to derive at a credit assessment of small farm holders across many regions in the world.

Q: Considering banks and other financial institutions have to follow due process and have to be able to quantify their decisions, how do you get them to “trust” your algorithms?

A: Firstly it is not easy for banks or financial institutions to deploy the kind of technology and resources one has to assess specifically for agriculture portfolio. For example data scientists to assess geospatial outcomes etc, it requires specialized skills And since it is our core expertise we are able to build that confidence, secondly we customize our products based on variables that the financial institution need. So the product is flexible to include the inputs that a financial institution may need for their decision-making process. Customization and ability to handle it from the comfort of their desktop helps them to get more involved and invested.

Q: When you talk about loans for farmers, you cannot ignore the land ownership records and all the issues that come along with it. How do you monitor land records at Harvesting inc?

It is definitely a challenging area and is something we focus on. We have created a Land Record Monitoring Cloud platform where we are not just collecting land records irrespective of language barriers, but also are able to get real-time information on change of ownership etc. We are able to get insights on loans taken against a particular land. We provide immediate information to banks on a change in ownership or multiple loans if at all taken against a land.

Q: Any remote sensing analysis involves the possibility for false/wrong classification. Considering that your credit score is actually going to change the life of a farmer, how do you ensure that the algorithms are accurate?

A: We do have a team of experts running continuous tests at all times to ensure that room for error or wrong classification is minimized.

Q: Harvesting is a startup that heavily utilizes remote sensing and spatial analysis. Could you tell us more about your tech stack and the programming languages that you use?

A: Our system is bit complex which is built in combination of several technology stacks and public cloud infrastructures. For remote sensing analysis, we are primarily using python on Linux servers. We have build a high-performance computing environment in the cloud where 10000s of computers runs in parallel to process data and create real-time information we need.

Q: You are already working with financial institutions in Turkey, India, Uganda, Kenya, Tanzania and Brazil. In your opinion, what would be the biggest challenge as you scale up and operate in more countries across the world?

A: The technology today allows us to spread our wings and there are no boundaries. In emerging economies that we cater to, there is still a lot of decision making that is in the hands of policymakers, bureaucracy that takes time to turnaround. Even banks and financial institutions have their set patterns and take time to adopt to newer avenues.

Q: As a startup founder (and serial entrepreneur), I am sure that there are many things that you must have learned along the way. What was the most interesting feedback that you received so far?

A: Focus on the customer and solving their pain points. They do not care about your cool technology per say. As long as we have a way to solve their pain points we are good.

Q: Where do you see Harvesting 3 years from now?

A: We do hope to see ourselves as being part of the financial inclusion drive for farmers across the emerging markets. We already are working in different parts of the world and we hope to set our footprints in every territory where there is a lack of finance for farmers and have many smallholders under banking umbrella.

Q: You are based in Fremont, California (USA) how’s the geo-startup scene? Are there many investors specifically looking at remote sensing and other geotech related companies? Are there any local meetups/events that cater to the geo-community?

A: Like customers, investors do not care about technology like remote sensing alone. They care about if a startup is able to create something lot of customers want and willing to pay. Having said that investors to understand the potential of remote sensing and there are more and more startups and funding coming along which touches geo/remote sensing.

Q: Okay, this is a tricky one – on a scale of 1 to 10 (10 being the highest), how geoawesome do you feel today? 😉

A: I do feel 9 on 10 as we have come a long way in terms of access of geo- spatial technology, its reach, its scope, and affordability.

Q: Any closing remarks for anyone looking to start their own geo startup?

A: Choose your tools smartly, it’s not about tech, it is about solving a real pain of a customer who is willing to pay for your solution.

If anyone would like to reach you, what would be the best way to do so?

They can reach out to us at info@harvesting.co

The Next Geo is supported by Geovation:

Location is everywhere, and our mission is to expand its use in the UK’s innovation community. So we’re here to help you along your journey to success. Get on board and let’s start with your idea…

Learn more about Geovation and how they can help turn your idea into reality at geovation.uk

About The Next Geo

The Next Geo is all about discovering the people and companies that are changing the geospatial industry – unearthing their stories, discovering their products, understanding their business models and celebrating their success! You can read more about the series and the vision behind it here.

We know it takes a village, and so we are thrilled to have your feedback, suggestions, and any leads you think should be featured on The Next Geo! Share with us, and we’ll share it with the world! You can reach us at info@geoawesome.com or via social media ?

If you enjoyed this article about Meeting Harvesting, read more and subscribe to our monthly newsletter!