Given that it has 20 percent of the world’s population, but only 7 percent of its arable land, China faces a big challenge in agricultural development. The future of China’s agricultural sector lies in modernization, and the key to advancing this modernization lies in the development of technology. This is why building a modern agricultural monitoring eco-system is important, and it is where digital and technological solutions can make a huge difference.

Given that it has 20 percent of the world’s population, but only 7 percent of its arable land, China faces a big challenge in agricultural development. The future of China’s agricultural sector lies in modernization, and the key to advancing this modernization lies in the development of technology. This is why building a modern agricultural monitoring eco-system is important, and it is where digital and technological solutions can make a huge difference.

Founded in 2016, Chinese startup Beijing McFly Technology Co., Ltd. aims to become the next generation, world-leading agricultural technology company. MCFLY is an AI and big data service provider focused on smart agriculture using modern agriculture platforms and smart farming technology, including drone and satellite imagery, and pattern modeling. The company provides information on local weather patterns and weed and insect threats to enable farmers to increase yields and confidently reduce pesticide use.

Three major departments: Agricultural Solutions, Technical Development, and Data Application

The headquarters of McFly is located in Beijing. More than 150 employees work here. The company also has five branches in China. Currently, McFly has three major departments: Agricultural Solutions, Technical Development, and Data Application. Agricultural Solutions generates 50% of revenue. Technical Development and Data Application share the other 50%.

- Agricultural Solutions: The focus is on UAV intelligent crop spray and smart crop protection. Business developers in this department help farmers to quickly leapfrog into modern, highly efficient agricultural techniques, and, at the same time, save water and reduce the use of fertilizers and pesticides. In 2020, McFly began to vigorously promote a franchise plan, hoping to cooperate with more franchisees to jointly expand the agricultural solutions market.

- Technical Development: The focus of this department is on agricultural research and development. The aim is to provide tools for the Agricultural Solutions department. 90% of employees in this department are scientists and developers. Most of the core technology in McFly comes from this department, including high resolution spatial/spectral integration, the McVision monitoring system, and pathological and pharmacological modelling.

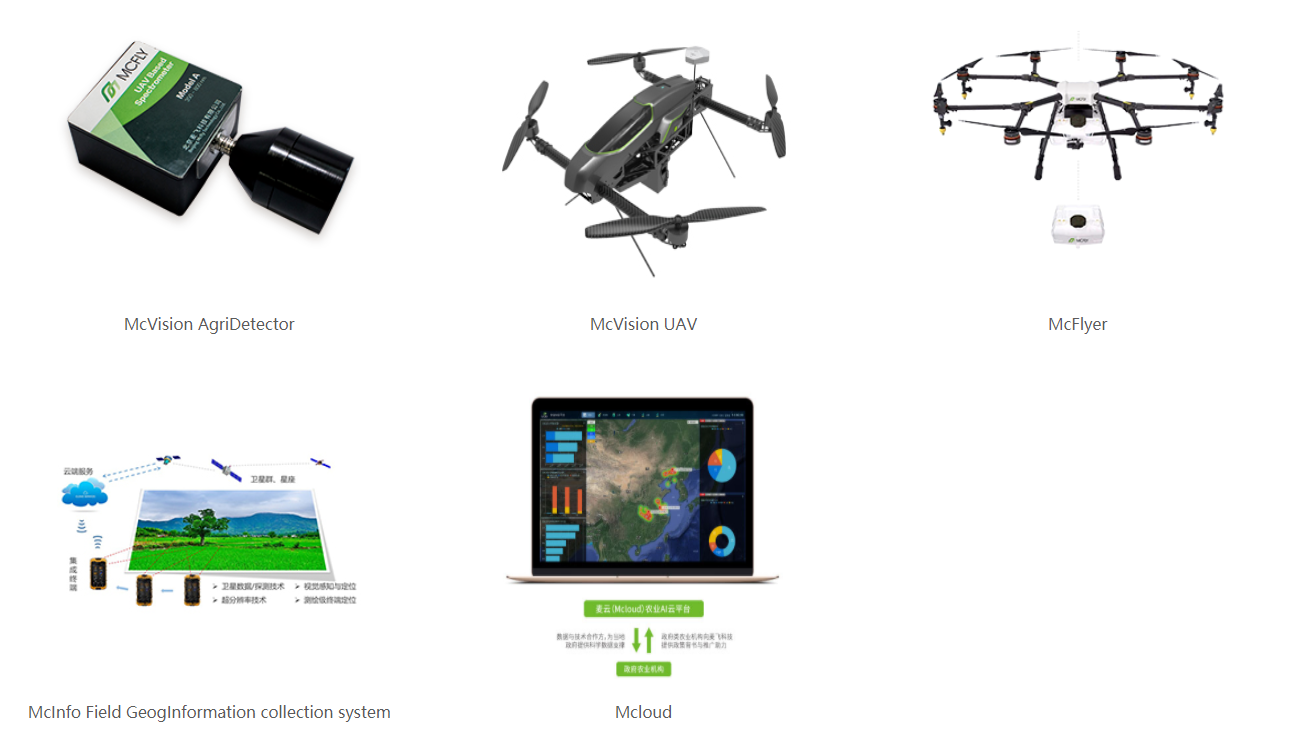

- Data Application: This department focuses on the demand for agricultural data from rural, financial and insurance institutions. McFly collects and cleans the data, and then inputs it into the McInfo Field GeogInformation collection system. Users are then able to access the data through Mcloud to meet their requirements.

According to the Chinese Ministry of Natural Resources, China has maintained strong grains in production of more than 650 million metric tons for the last five consecutive years. Although the market is huge, agricultural modernization has been slow for historical reasons. How can the market be rapidly expanded to provide the products that users need? The co-founder and CTO of McFly, Long Liu, listed four main points:

- Software and hardware integration: In the Chinese market, selling hardware and software separately is not a solution. Therefore, an integrated software and hardware solution is McFly’s flagship product. Through hardware products such as McVision AgriDetector and McVision UAV, McFly is able to provide precision fertilization, pesticide spraying, and pest detection, supported by software systems such as the McInfo Field GeogInformation collection system and Mcloud.

- Core technology research: McFly regards itself as a technology service supplier, mainly focusing on databases and algorithms for agricultural remote sensing. Although McFly has hardware and software partners, the company insists on developing its own core algorithms and systems.

- Ensuring production: Increasing agricultural production is not the key issue farmers are concerned about. How to ensure production, is the key problem. Therefore, the monitoring of grain diseases and insect pests are the biggest challenges to maintaining agricultural production. In this regard, McFly focuses on rice production, which is the main food demand in China. The founding team at McFly has more than 30 years of experience in rice research from several academic institutions, and have built a large number of rice production, disease and pest monitoring models to maintain production levels.

- Matching customer needs: The Chinese agricultural market’s huge size means there are large differences in customer requirements. McFly currently focuses on medium-to-large enterprises. These customers have long-term plans and well-funded budgets, with the intention of building agricultural infrastructure to meet future challenges. Therefore, they tend to buy integrated software and hardware products and solutions.

100 million yuan revenue and global strategies

At present, the annual revenue of McFly is nearly 100 million yuan. The two major rice-production provinces of Jiangsu and Hubei provide nearly 80% of the revenue.

“Although people were affected by COVID-19 this year, the agricultural industry is stable. Agriculture is the basic industry of China. In technical development and data application, McFly’s revenue increased in 2020,” said Long Liu.

At the end of 2019, McFly announced four global strategies, including establishing a digital farm in Montreal, Canada, and the acquisition of Canadian smart agriculture start-up, Geospatial Vision.

Biggest challenge

In the agricultural service market, customers often compare McFly with DJI and XAG. In fact, DJI and XAG focus more on hardware. McFly, on the other hand, is also a technology service supplier, but mainly focuses on remote sensing technology, algorithms, and data for agriculture.

The core advantage of McFly is the accumulation of data and models. Sufficient time is required to understand a crop and develop crop production models. Furthermore, McFly hopes to create a standard for establishing crop production models, and standardize more models.

“More and more farmers accept UAV for agricultural services,” said Long Liu. In the next ten years, rapid growth is forecast for the Chinese agriculture service market, which will increase the company’s market share and provide further opportunities. The biggest challenge for farmers at present is funding, not technology. Agricultural technology has been developing for many years in China, and consequently, modern technology has developed beyond the basic needs of most farmers. The biggest burden of most farmers is to acquire funding to take advantage of smart devices that support agricultural production.

[This article was first published on 36Kr and been republished on Geoawesomeness]