China’s Smart Agriculture Boom Has Tech Potential but Requires Affordable Solutions

1.5 billion. This is the population of China.

Since at least 1950, China has been the most populated country in the world. Surpassed by India in 2022, China is currently the second most populated country with just above 1.4 billion inhabitants and a declining population.

However, the number of farmers is also decreasing. In 1990, 60% of the Chinese labor force was employed in agriculture. But this number dropped to 23% in 2022. This decline has been driven by urbanization and industrialization, which has attracted rural workers to urban areas for better employment opportunities.

What’s the solution? The Chinese government recognizes that agriculture is crucial for feeding its huge population and supporting long-term development. As a result, the governors in China wish to make farming more attractive and high-return by using modern technology. These efforts are necessary to ensure food security and increase agricultural productivity without harming the environment.

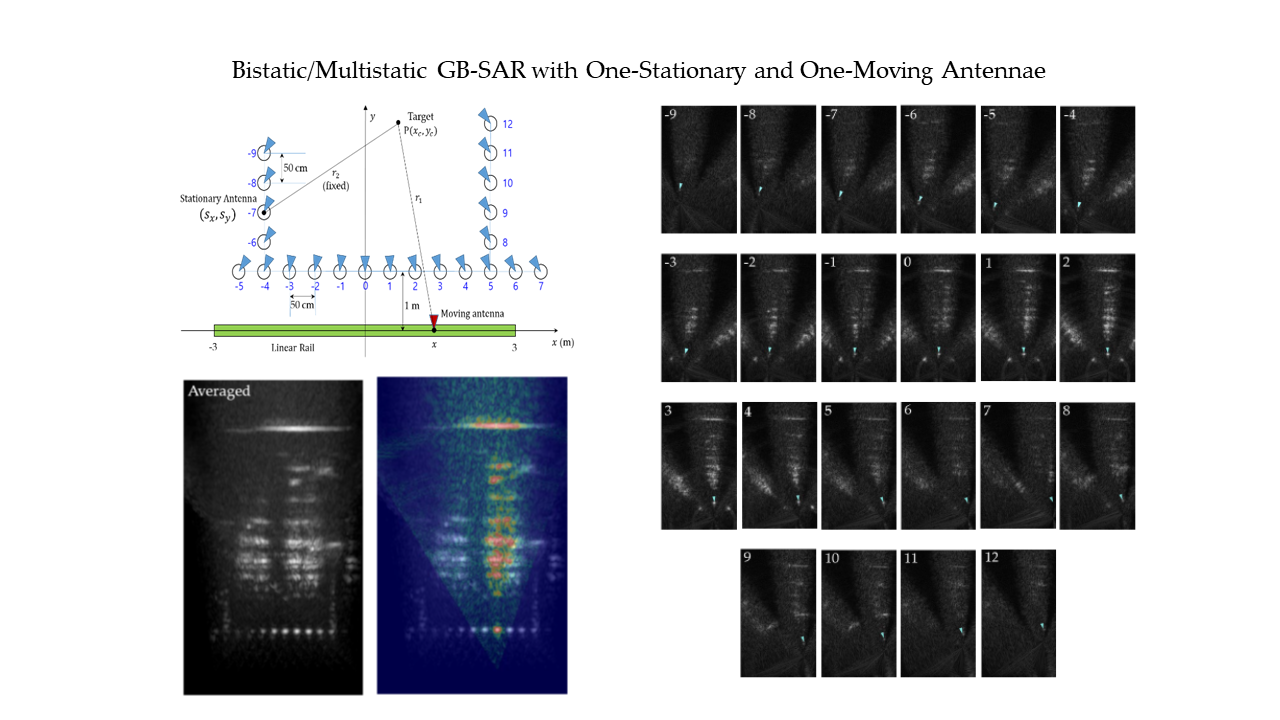

To meet these goals, the Chinese government is increasingly encouraging more smart agricultural technologies, exploring how innovative solutions like remote sensing, UAVs, and IoT can revolutionize farming practices, making them more efficient and less labor demand.

Sustainable Agriculture Platform (FAO) Source: Mirjana Maksimovic

Market: From policy to strategy

As a relatively land-scarce country, the per capita arable land in China is less than one-fifth of that in the United States. Between 1997 and 2008, China witnessed a decrease in its total farmland by 125 million mu (approximately 8.3 million hectares).

In response to this rapid shrinkage, the Chinese government instituted several measures. The most famous two are “Redline” and “No. 1 Central Document”.

In 2006, the Chinese government set a “Redline” for farmland. This “Redline” set the minimum arable land at about 300 million acres (121 million hectares) by 2020, with a specific focus on protecting 255 million acres of high-quality farmland.

“No. 1 Central Document” is the first policy statement released at the start of each year by the China Central Committee, and has long served as an indicator of government priorities. Since 2004, the ‘No. 1 Central Document’ has emphasized agriculture, rural areas, and farmers as top national priorities for 20 consecutive years. It underscores the non-negotiable minimum of 1.8 billion mu (120 million hectares) of total arable land, reflecting the government’s commitment to agricultural self-reliance.

The Red Line Policy in China, Source: China SCIO

Why does China prioritize agriculture at such a high level?

China’s emphasis on agriculture extends beyond the mere need to feed its population. From a political perspective, agricultural independence is crucial for national security. China is the world’s largest agricultural importer. However, regional conflicts or international sanctions might threaten China’s ability to import food. Therefore, ensuring a robust and self-sufficient agricultural sector is part of China’s long-term strategy for the “great rejuvenation of the Chinese nation”.

In this case, the Chinese agricultural market is stable in growth. In 2022, the added value of agriculture and related industries in China came in at 19,569.2 billion yuan, accounting for 16.24 percent of the country’s gross domestic product (GDP). According to the statistics, an annual growth rate of 5.95% is expected.

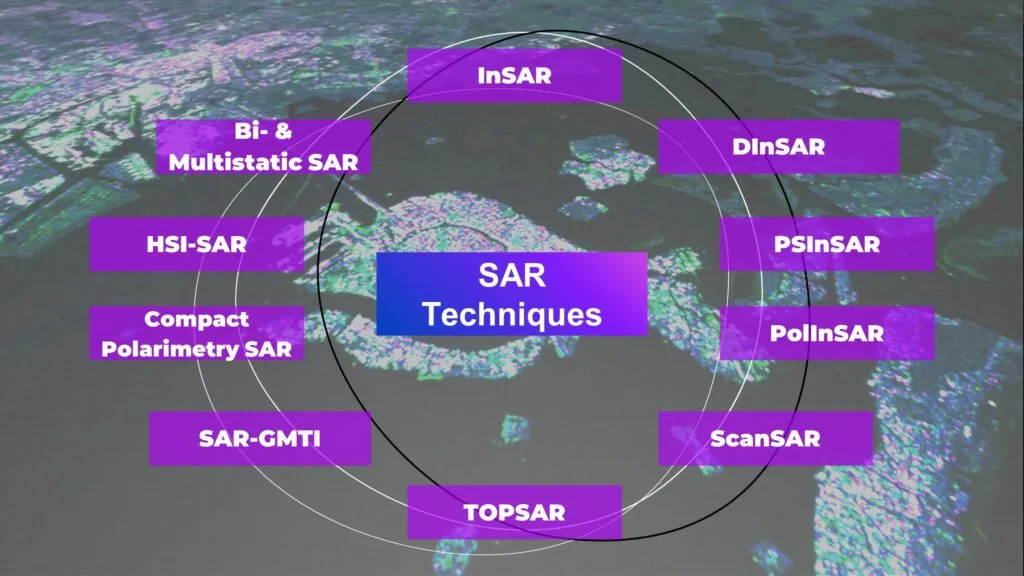

Opportunities for Remote Sensing and GIS

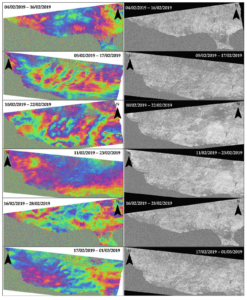

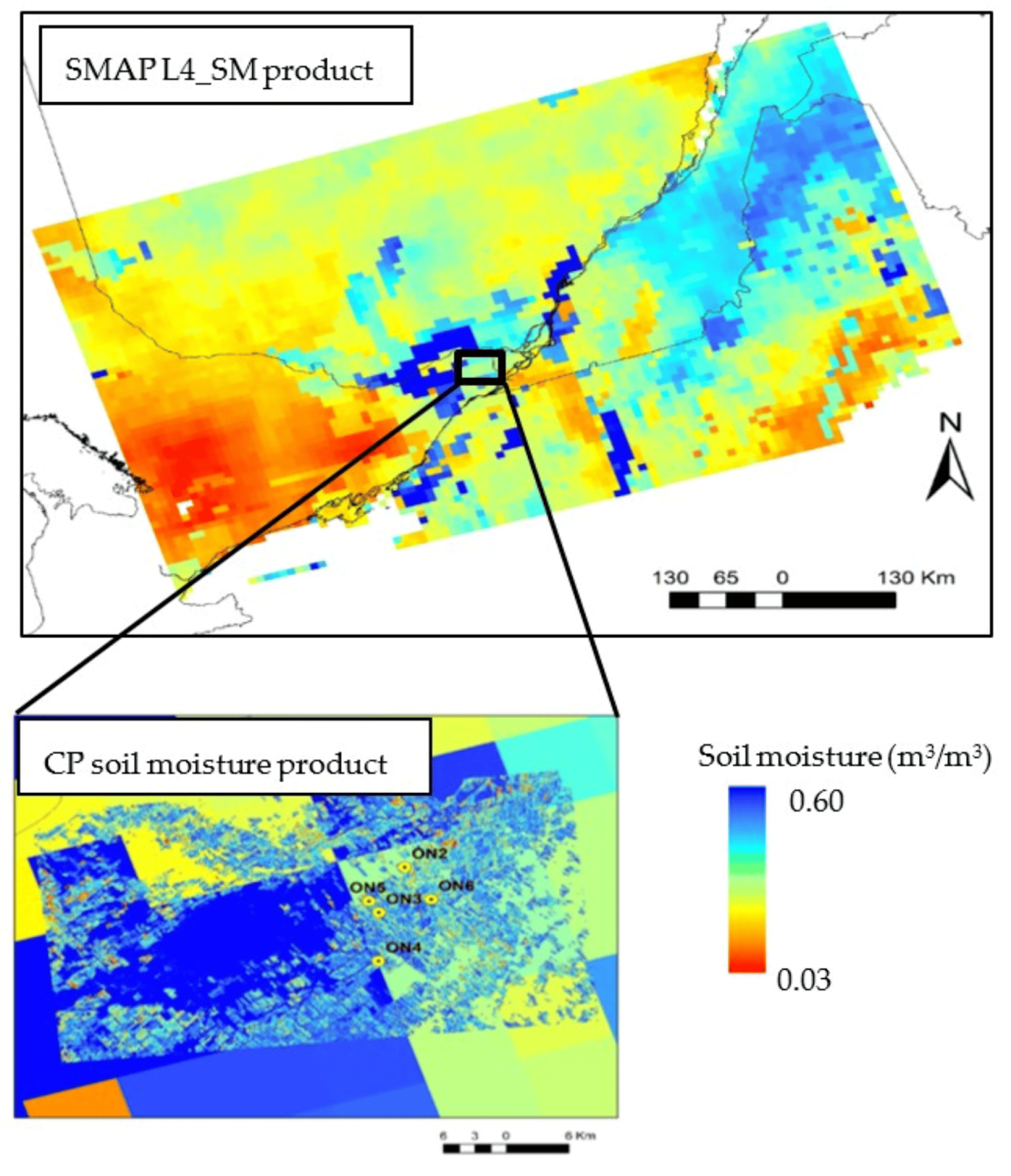

The two famous policies, Redline and No. 1 Central Document boost the smart agricultural market in China. The government needs to monitor the arable land, from the size to the plants. Agricultural producers want to trace the plants for consumer and distribution sectors. Financial institutions need agricultural data insights to support inclusive loans for farmers without traditional income proofs.

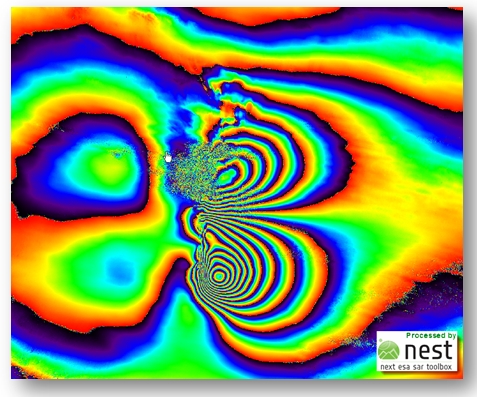

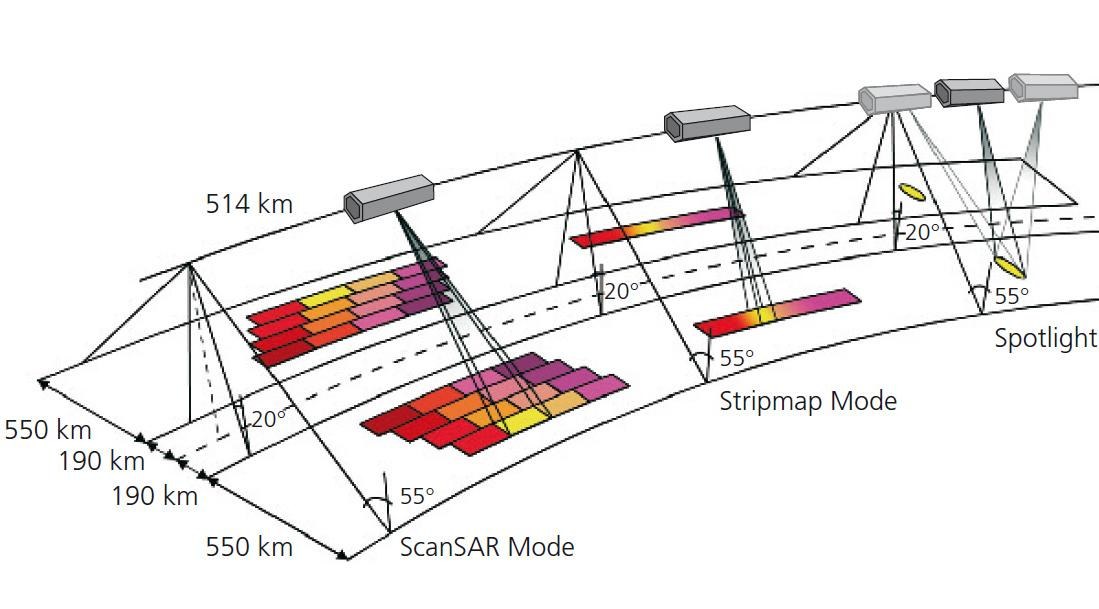

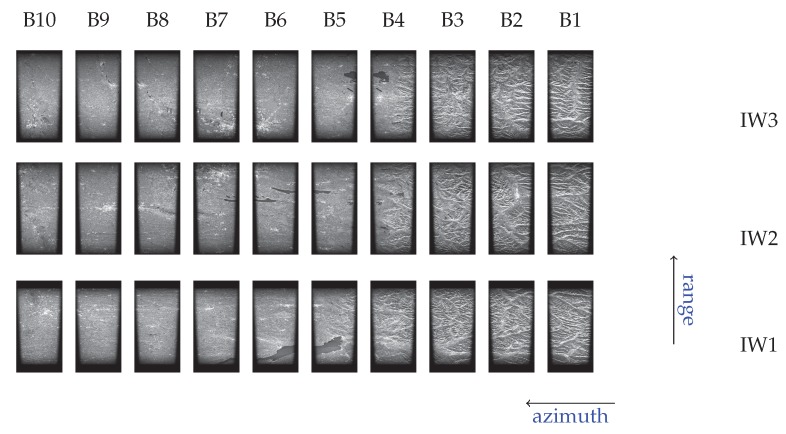

With different demands from agricultural stakeholders, the common need for them is support from remote sensing and GIS. The reliance on remote sensing and GIS primarily stems from the unique challenges posed by the Chinese agricultural landscape. Despite the vast expanses of arable land, these are distributed unevenly, with many small farmers managing scattered plots across large areas. This fragmentation makes it difficult to provide customized support that caters to the specific needs of each smallholder. Additionally, the agricultural sector requires continuous monitoring to track changes over time, manage resources efficiently, and enhance crop yields.

Remote sensing excels in providing extensive, time-series earth observations that enable consistent monitoring of these large and disparate agricultural areas. This capability makes it an indispensable tool for stakeholders aiming to optimize farming practices, assess environmental impacts, and support sustainable development. Therefore, more remote sensing start-ups have joined the market in the last 10 years.

Smart Agricultural Tech, Source: Jiahe Info

Remote Sensing in Farming, Finance, and Insurance

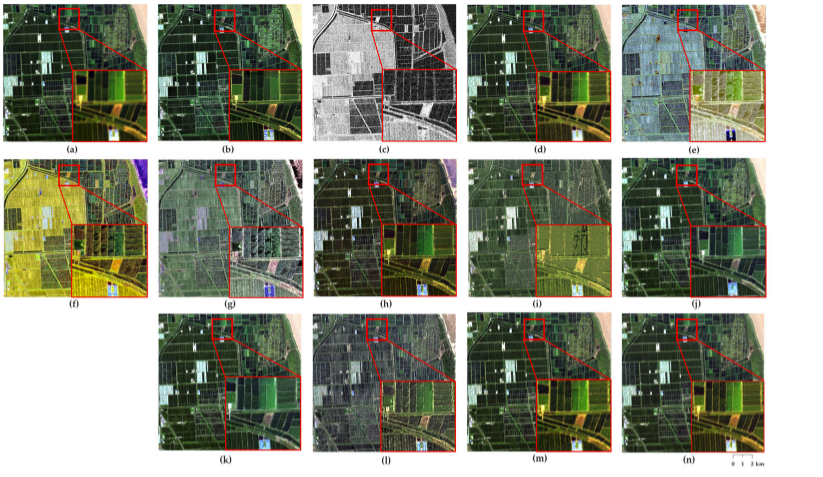

In the realm of remote sensing applications in agriculture, ICAN Technology(爱科农), GAGO group(佳格天地), and Jiahe Info(珈和科技) are three pioneers. Despite all being in the field of remote sensing, it is very interesting that they have different focus and target customer groups.

Planting is the basis of agriculture. Established in 2016, ICAN is a leader in intelligent planting decision-making services in China. ICAN independently developed a plant soil atmosphere continuum model and ICAN big data agricultural platform, based on satellite and UAV technologies. The platform supports pre-planning, in-process tracking, and post-harvest monitoring, enabling precise management guidance. Utilizing this platform, ICAN develops solutions that enhance efficiency and reduce costs for agricultural producers, from large-scale farms to traditional agricultural businesses. The company has secured A+ round funding from prominent investors including Linear, Hillhouse, Tencent, IDG, etc.

GAGO Group, founded in 2015, leverages satellite imagery and IoT to provide insights and financial solutions for agricultural stakeholders. They particularly focus on enhancing the accessibility of financial services in rural areas, where traditional banking infrastructure is limited. For example, the company uses satellite imagery to assess crop health and property stability, enabling the provision of asset and income data to banks, thus facilitating loans for farmers without traditional income proofs.

GAGO Group has established a broad network of partners and clients, including large-scale agricultural producers and government agencies, with whom they work to supply traceable data for consumer and distribution sectors. Financial institutions also work with GAGO to integrate these agricultural data insights with financial products to support inclusive financing. Additionally, the company has successfully completed four rounds of financing to fuel its growth and further its technological advancements.

Jiahe Info, another pioneer in agricultural remote sensing technology, was founded in 2013. Jiahe has recently completed its B+ round of financing, amounting to nearly one hundred million yuan. Over the past decade, Jiahe Info developed two technological platforms, from AI algorithms to low-code tools. However, these platforms still have high thresholds. Users can only make good use of the platforms with prior knowledge of remote sensing. However, most of their customers come from agriculture, academia, and insurance. Most of them lack remote sensing knowledge. Recognizing the need to be closer to its clients, Jiahe Info has transitioned from merely providing data, algorithms, and tools to offering comprehensive SaaS solutions. Now, instead of a general platform for every user, its latest solutions are tailored to specific agricultural and insurance needs—facilitating more intuitive and practical applications for end-users. To date, Jiahe Info has established collaborations with over 2,700 clients.

For farmers, the adoption of these technologies could translate into significantly improved yields, reduced environmental impact, and enhanced decision-making capabilities. Especially for smallholders of China’s agricultural workforce, who can’t afford technologies such as drone-based monitoring systems and IoT-enabled agricultural devices, EO-based tech can be a cheaper but efficient solution, which can provide critical data on soil health, crop status, and water needs. By receiving timely insights, farmers can make more informed decisions about irrigation, fertilization, and pest management, leading to better crop management and reduced resource waste.

Agricultural Insurance Platform, Source: Jiahe Info

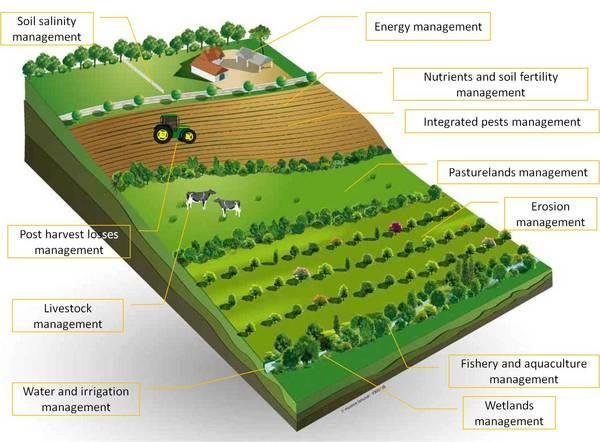

Geospatial Big Data in Supply and Demand

While Remote Sensing primarily focuses on the direct observation and analysis of agricultural environments, GIS takes a broader approach on the agricultural data. Companies like YIMUTIAN (一亩田) and BRIC Agricultural Information Technology (布瑞克) exemplify how this technology harnesses the power of spatial data analytics to address significant market challenges.

YIMUTIAN, founded in 2011, is a leading digital platform for agricultural products in China, specializing in solving the critical “difficulty of selling” issue faced by farmers. The platform has served over 50 million agricultural users, facilitating more than 300 billion yuan in annual transactions. YiMuTian has transformed agricultural trade by digitizing the entire supply chain from production to distribution, enabling efficient online and offline sales channels. The platform supports a vast array of agricultural products with over 800,000 SKUs from 2,800 counties nationwide, effectively linking farmers with wholesale markets and buyers through its comprehensive digital ecosystem. Additionally, YiMuTian collects and utilizes geospatial big data on agriculture, such as supply & demand trends and wholesale flows, creating detailed maps to provide a better understanding of market dynamics, further aiding farmers and buyers in making informed decisions.

Agricultural Big Data Platform, Source: YIMUTIAN

BRIC Agricultural Information Technology, founded in 2014, is a key player in agricultural big data. The company offers a wide range of services, including agricultural consulting, market research, and modern agricultural planning. It also operates several platforms such as an agricultural big data platform, a B2B e-commerce site for agricultural products, and a B2C e-commerce site catering to individual consumers. BRIC has made significant strides in integrating data across the production, supply chain, sales, and customer service sectors to connect various agricultural stakeholders, thereby reducing the costs associated with information asymmetry. The company successfully expanded its B2B platform, which primarily deals with bulk agricultural products, contributing significantly to its revenue, which encompasses 80% of its total income.

End consumers benefit from the integration of geospatial tech as well. With greater efficiency in farming and supply chains optimized through geospatial analytics, the market can expect a more stable supply of agricultural products. This stability helps in maintaining lower prices and higher quality of produce reaching the consumer markets. Moreover, enhanced traceability and transparency in farming operations ensure that consumers have access to safer and more sustainable food options.

UAV Giants in Agriculture: From China to Overseas

In the fast-evolving landscape of agricultural technology, UAVs have marked a significant footprint. Leading this innovation from the front are Chinese companies DJI Agriculture (大疆农业) and XAG (极飞科技), which have a large market share both domestically and internationally. DJI Agriculture is a subsidiary of DJI, founded in 2015.

By 2020, the sales of agricultural drones in China surged to approximately 50,000 units, a significant increase from 4,250 units in 2017. This rapid growth underscores the booming interest and investment in drone technology within the agricultural sector. DJI Agriculture and XAG collectively held over 90% of this market, with DJI capturing the largest share at 54.82% and XAG following closely at 37.59%.

The reach of these companies extends far beyond the borders of China. By the end of 2022, DJI Agriculture boasted a global sales tally of 200,000 units, while XAG reported 120,000 units sold worldwide. This growth is reflective of a maturing domestic market largely monopolized by these two giants.

DJI agricultural UAV, Source: DJI Agriculture

Recent developments have seen XAG pushing the envelope on pricing strategies, which has sparked a price war of sorts in the agricultural UAV sector. XAG introduced a new drone model priced at 40,000 yuan, significantly undercutting previous market prices and setting a new low for agricultural drones with comparable payload capacities. DJI responded immediately by reducing their prices by 8,000 yuan, bringing their starting price down to 40,000 yuan as well.

This aggressive pricing strategy by XAG is not merely about capturing market share but also reflects the broader industry trend towards more affordable, high-capacity UAVs. For instance, the new XAG P150 drone significantly enhances payload capabilities to 70 kilograms, a stark contrast to their earlier P20 model, which could only carry 6 kilograms. This advancement means that a single drone flight can now cover more acreage faster and more efficiently, greatly improving operational productivity for farmers.

The reduction in drone prices over the years—from nearly 100,000 yuan for the P20 suite in 2016 to 40,000 yuan for the P150—illustrates the dramatic cost efficiencies achieved through technological advancements and economies of scale. XAG has been able to maintain a high gross margin above 30% despite lower prices, benefiting from reduced costs in chip manufacturing and energy storage, paralleling the supply chain efficiencies seen in the electric vehicle industry.

XAG P150 agricultural UAV, Source: XAG

Moreover, XAG and other companies are not only focusing on UAVs but are also expanding into autonomous vehicle technologies such as autopilots for tractors. This diversification signifies a shift towards comprehensive automation solutions in agriculture, emphasizing cost-effectiveness and accessibility.

With XAG’s CEO Peng Bin predicting a potential domestic market capacity of 500,000 agricultural drones, there remains substantial growth potential. This forecast hinges on the continued decrease in UAV costs and a rebounding economy, suggesting a future where these technologies are even more integral to agricultural productivity.

XAG Smart Agriculture System, Source: XAG

Smart Agriculture: Affordable solutions for more farmers

China’s vast agricultural sector presents significant opportunities, along with sizable challenges. Land fragmentation remains a key obstacle. More than 98% of agricultural business entities in China are still small farmers. These farmers often struggle to afford improvements to their equipment, let alone invest in advanced smart devices. Realizing the technical benefits widely requires addressing the affordability of such solutions. The role of government subsidies and public-private partnerships becomes critical here.

On the other hand, much of the risk resistance capacity in agriculture is provided by the government, which subsidizes insurance, purchases smart agricultural applications, and provides these technologies to farmers. Consequently, in China’s agricultural business landscape, while farmers are the primary users, the actual customers are predominantly the government. By supporting the initial investment costs for advanced agricultural technologies, these initiatives can help alleviate the financial burden on small farmers, making it feasible for them to adopt innovative solutions.

Small agricultural business entities in China, Source: Tuliu

The government’s need for scalable solutions has made satellite imagery particularly appealing. This technology offers a cost-effective, large-scale alternative that reduces the need for extensive on-site personnel.

Insurance companies face a similar situation where the cost of dispatching underwriting staff to the field can exceed the potential claims, making remote sensing technologies an invaluable tool. They leverage remote sensing and GIS to revolutionize claim processing in agriculture. These technologies allow for accurate, real-time monitoring of agricultural lands, enabling insurers to assess damage and process claims without the need to send staff on-site. This not only reduces operational costs but also speeds up the claims process, providing timely support to farmers affected by adverse conditions.

Moreover, for farmers, the ability to respond to natural disasters is crucial, and remote sensing alongside GIS plays a pivotal role. These technologies offer critical early warning systems and detailed damage assessments post-disaster, allowing for quick response and better preparation for future incidents. The data collected helps in documenting the extent of damage for insurance claims and in planning the recovery of agricultural operations.

Affordability is still the most crucial factor. Remote sensing solutions are favored not only for their effectiveness but also for their lower costs compared to IoT devices. Given that agriculture does not typically require high temporal resolution, the sector can utilize freely available satellite imagery, such as that from Sentinel and Landsat, which provides another layer of cost efficiency.

Yet, the greatest opportunity lies in further digitalization, extending beyond remote sensing and geospatial analysis into areas like finance and insurance. It’s unrealistic to expect agricultural stakeholders to be familiar with technical concepts such as NDVI or radiometric calibration. The industry must translate complex data into actionable insights that end users can easily understand. This transformation of data into practical knowledge represents a substantial opportunity for true smart agriculture, harnessing digital advancements to make a real impact on the agricultural sector.

Did you like this post on smart agriculture? Read more and subscribe to our monthly newsletter!